Global ad spend is expected to surpass $1 trillion in 2026, and programmatic advertising is projected to account for ~90% of global display ad spending. This automated approach to buying ad space offers incredible power. But that power depends entirely on the technology you use.

Choosing the right programmatic advertising platforms is the single most important decision for your campaign's success. The wrong choice leads to wasted budget and missed opportunities. The right choice unlocks unparalleled targeting, efficiency, and return on investment.

This guide provides a comprehensive overview of the top platforms. We will help you navigate the complex ecosystem and select the best tools for your business goals in 2026 and beyond.

Key Takeaways:

- Programmatic advertising uses automation to buy and sell digital ad space in real time, making campaigns more efficient and targeted.

- The core ecosystem consists of demand-side platforms (DSPs) for advertisers, supply-side platforms (SSPs) for publishers, and data management platforms (DMPs) for audience data.

- Top DSPs like Google DV360, The Trade Desk, and Amazon DSP offer unique strengths in inventory access, data integration, and targeting capabilities.

- Choosing a platform requires defining your goals, assessing your budget, and evaluating features like brand safety, targeting options, and analytics support.

- Measuring success is impossible without a unified view of your data. Integrating platform data is crucial for accurate performance analysis and optimization.

What Is Programmatic Advertising?

Programmatic advertising is the automated buying and selling of digital ad inventory. This process happens in real time through complex software platforms. It removes many of the manual tasks involved in traditional ad buying. Tasks like negotiating prices and managing insertion orders are handled by machines.

This automation allows for more precise and efficient campaigns. Advertisers can target a specific audience with relevant messages at the right moment. The entire transaction occurs in the milliseconds it takes for a webpage to load.

How Programmatic Bidding Works

The most common method is Real-Time Bidding (RTB). RTB is an open auction where ad impressions are sold to the highest bidder on an impression-by-impression basis. However, other methods exist:

- Private marketplace (PMP): An invitation-only auction. Publishers offer premium inventory to a select group of advertisers. This provides more control and transparency than the open market.

- Programmatic direct: A one-to-one deal where inventory and pricing are agreed upon beforehand. The execution is automated, but the deal terms are pre-negotiated.

- Preferred deals: Advertisers get a first look at inventory at a fixed price before it goes to the open auction. They can choose to buy it or pass.

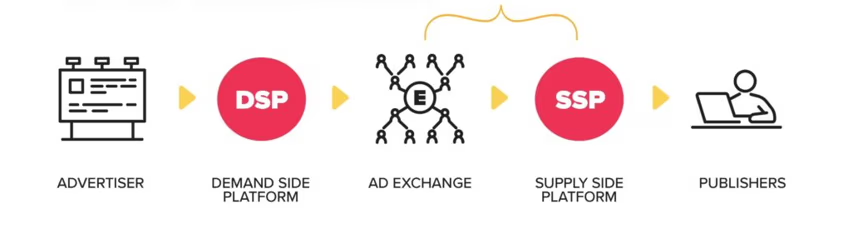

The Core Ecosystem: DSPs, SSPs, DMPs, and Ad Exchanges

Four key components work together to make programmatic advertising possible.

- Demand-side platform (DSP): This is the advertiser's tool. They use it to buy ad impressions from multiple sources and manage their campaigns across different publishers.

- Supply-side platform (SSP): This is the publisher's tool. They use it to sell their ad inventory automatically to the highest bidders, maximizing their revenue.

- Ad exchange: This is the marketplace. It connects DSPs and SSPs, facilitating the auction where ad inventory is bought and sold.

- Data management platform (DMP): This is the data hub. It collects, organizes, and activates first-party and third-party audience data to help advertisers find their target audience.

The Tangible Benefits of Programmatic Advertising

Why has programmatic become the standard for digital advertising?

The advantages are clear and significant. It provides a level of control and insight that manual buying simply cannot match. Marketers who leverage it effectively gain a serious competitive edge.

Unparalleled Targeting Precision

Programmatic platforms let you target audiences based on demographics, interests, browsing behavior, location, and purchase history. This level of precision ensures that ads reach the right users at the right moment.

That precision drives results: retargeting through programmatic can improve ROAS by 2x to 4x on average, significantly increasing the value of every dollar spent.

Reducing wasted impressions means lower overall media costs and improved campaign efficiency.

Real-Time Campaign Optimization

Programmatic is built for real-time campaign adaptation. You do not set tactics upfront and hope for results. You monitor performance continuously.

Data appears instantly. Bids, audiences, and creative can be adjusted on the fly. This capability drives measurable improvement — across CPM, conversions, and engagement. In fact, campaigns that use dynamic creative optimization deliver 20–60% higher CTRs than static ads.

This real-time feedback loop is one reason programmatic campaigns routinely reduce wasted impressions by 15–35% using frequency controls and audience refinement.

Increased Efficiency and Scalability

Automated bidding and media selection replace hours of manual planning. Your team spends less time negotiating deals and more time on strategy and creative optimization.

Programmatic also gives you access to massive global inventory across display, video, mobile, and CTV environments. Mobile alone accounts for about 71% of programmatic spend, showing how widely these campaigns can scale.

Automation scales campaigns without exponentially increasing workload.

Deeper Audience Insights and Data Collection

Every programmatic interaction produces data. Those data points give you high-resolution insights into audience preferences, engagement rates, and conversion behavior.

Armed with this intelligence, you can refine messaging, segment audiences more effectively, and optimize media placement. Decisions shift from reactive to proactive.

A strong data governance strategy ensures your insights are accurate, compliant, and actionable across channels.

Quantifiable Performance and ROI Gains

Programmatic delivers measurable performance benefits that directly impact the bottom line:

- 25-45% lower CPMs vs traditional direct-buy display.

- 10-30% improved conversion rates when paired with audience data.

- Retargeting lifts ROAS 2-4 times on average.

- Multi-channel programmatic campaigns produce 22% higher recall than single-channel buys.

These figures illustrate that programmatic is fundamentally more effective at converting spend into outcomes.

Top Demand-Side Platforms (DSPs) for 2026: A Detailed Review

Demand-Side Platforms are the command centers for advertisers. Choosing the right one is critical. Each platform offers unique features, inventory access, and data capabilities. Here’s a breakdown of the leading DSPs you should consider.

Google Display & Video 360 (DV360)

Google Display & Video 360 (DV360) is an enterprise-grade demand-side platform that allows marketers to plan, buy, and optimize media across display, video, YouTube, native, audio, and connected TV.

What sets DV360 apart is its deep integration with the broader Google Marketing Platform, including GA4, Campaign Manager 360, and Search Ads 360. This enables unified audience targeting, cross-channel frequency management, and more accurate attribution.

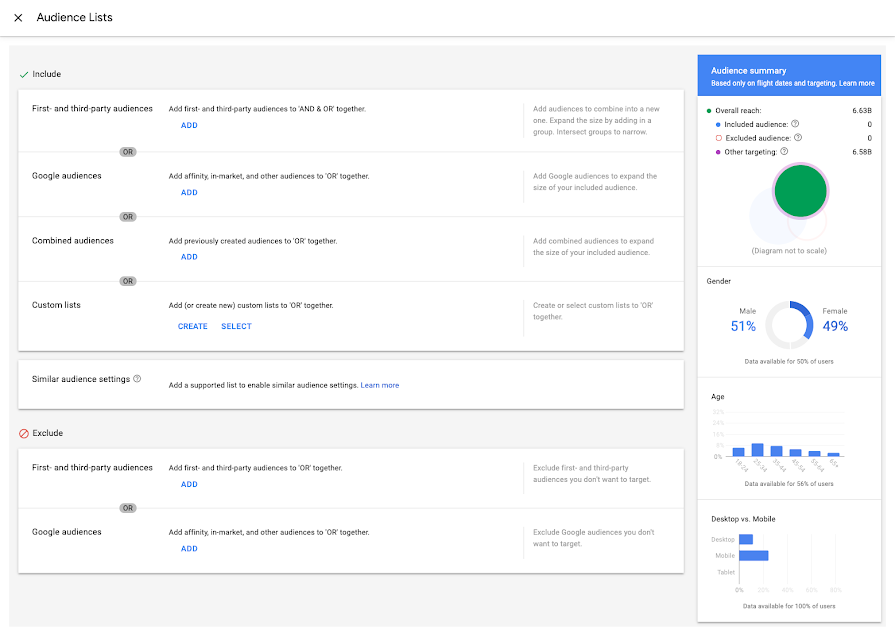

DV360 offers access to premium inventory through both open exchanges and programmatic guaranteed deals. Its advanced tools allow for precise audience segmentation using first-party data, Google audiences, or custom intent signals, making it suitable for both brand and performance goals.

For organizations managing multi-channel media at scale, DV360 provides strong governance, collaborative workflows, and granular control over campaign performance.

- Pricing: Percentage of media spend (typically 7–15%), plus potential data and tech fees

- Supported Ad Inventory: Broad access to open exchanges, private marketplaces, YouTube, CTV, audio, native, display, mobile

- Audience Targeting: 1st-party, 3rd-party, Google audiences, custom affinity, in-market, lookalike, and intent-based; supports GA4 and CDP integrations.

- Anti-fraud/Safety Measures: Built-in protections via Google’s proprietary systems; integrates with third-party tools (e.g., IAS, DV, MOAT); supports brand safety, viewability, and fraud prevention standards

The Trade Desk

Alongside a DSP, The Trade Desk offers a DMP to help advertisers and publishers collect, manage, and activate their data in one place.

One of its most popular features is its lookalike modeling which allows you to discover new audiences based on insights from your existing audiences. It also offers a data marketplace where users can access high-quality audiences from data providers.

TheTradeDesk is actively expanding in the DMP sector. For example, TikTok and theTradeDesk launched a partnership not long ago. This collaboration will drive more brands to the platform and stimulate the growth of advertising on TikTok.

Amazon DSP

Amazon DSP is a demand-side platform that enables advertisers to programmatically buy display, video, and audio ads both on and off Amazon’s owned properties. It offers access to Amazon’s unique, high-intent audience segments derived from real-time shopping and browsing behavior.

Advertisers can target audiences based on purchase history, product views, or shopping patterns. With built-in measurement tools, advertisers can track conversions, brand lift, and retail outcomes like sales and detail page views.

Amazon DSP is especially valuable for brands selling on Amazon, but it also serves non-endemic advertisers seeking access to high-quality inventory, advanced targeting, and retail-linked attribution.

- Pricing: CPM-based; typically requires a $35K–50K/month minimum for managed service

- Supported Ad Inventory: Display, video (including Fire TV, Twitch, IMDb), audio, mobile, and third-party web/app inventory

- Audience Targeting: Amazon 1st-party behavioral, in-market, lifestyle, purchase data; CRM/retargeting; lookalike modeling

- Anti-fraud/Safety Measures: Proprietary fraud detection backed by Amazon data; verified inventory; integrates with third-party tools

Adobe Advertising Cloud DSP

Adobe Advertising Cloud DSP prides itself as “the only omnichannel programmatic DSP that supports connected TV, video, display, native, audio, and search campaigns.”

Mentioned as a leader in the Gartner Magic Quadrant for Ad Tech, Adobe provides features that help advertisers launch, manage, and optimize campaigns. This includes inventory management, personalized marketing, search management, and more.

- Pricing: Custom. Pricing depends on different factors like company size, requirements, and the number of tools purchased

- Supported Ad Inventory: Display, video, audio, mobile apps, Digital out of Home (DOOH), TV, native, and social

- Audience Targeting: Audience segment, device type, location, browser, and more

- Anti-fraud/Safety Measures: Offers page screening for detecting faulty inventory and pre-bid filtering for detecting fraud, suboptimal viewability, and brand violation.

MediaMath

Launched in 2007, MediaMath is one of the best programmatic advertising platforms (DSPs) in the industry. Today, it partners with over 3,500 advertisers to help them run omnichannel campaigns across mobile, display, OTT, native, video, audio, and more.

Its SOURCE ecosystem is designed to help advertisers achieve better supply-path optimization and algorithm decision. MediaMath is also recognized as a leader in the Gartner Magic Quadrant for Ad Tech.

- Price: Custom

- Supported Ad Inventory: Connected TV, display, mobile, video, audio, native, and DOOH

- Audience Targeting: Audience segment, contextual, first-party data, site list, location, daypart, technology, video, and audio.

- Anti-fraud/Safety Measures: Uses its SOURCE ecosystem to ensure supply-chain trust through pre-bid IVT protection and onboarding tools.

StackAdapt

StackAdapt is a self-serve, AI-powered DSP.

A key differentiator of StackAdapt is its integration of advertising technology (adtech) and martech functionalities. The platform's Data Hub enables seamless activation of first-party data, facilitating personalized and privacy-compliant campaigns. Additionally, the inclusion of native email marketing tools allows for coordinated messaging strategies within a single platform.

StackAdapt offers advanced targeting options, such as contextual targeting powered by proprietary AI, account-based marketing (ABM), and precise geolocation targeting.

- Pricing: CPM-based; no minimum spend for self-serve; managed service available with variable thresholds

- Supported Ad Inventory: Native, display, video, audio, CTV, in-game, DOOH, and email

- Audience Targeting: 1st-party data, contextual AI, lookalike, ABM, geolocation, keyword, site lists, and retargeting

- Anti-fraud/Safety Measures: Integrates with third-party verification (IAS, HUMAN, etc.); pre-bid filters, domain blocklists

DSP Comparison: Finding Your Best Fit

Selecting a DSP depends heavily on your specific needs, budget, and technical expertise. This table provides a high-level comparison to guide your decision-making process.

| Platform | Best For | Key Features | Inventory Access | Primary Data Advantage |

|---|---|---|---|---|

| Google DV360 | Large advertisers in the Google ecosystem | YouTube access, deep Google stack integration | YouTube, Google Ad Exchange, open web | Google audience segments, GA4 data |

| The Trade Desk | Independent agencies and brands | Transparent model, strong CTV and audio, UID 2.0 | Massive open web, premium publishers | Cross-device graph, third-party data marketplace |

| Amazon DSP | E-commerce and CPG brands | First-party shopper data, retail attribution | Amazon sites, Fire TV, Twitch, open web | Amazon purchase and browsing data |

| Adobe Ad Cloud | Enterprise omnichannel marketers | Full Adobe Experience Cloud integration | Display, video, search, TV (linear and CTV) | Adobe Analytics and Audience Manager data |

| StackAdapt | Mid-market brands and agencies | AI-powered contextual targeting, user-friendly UI | Native, display, video, CTV, DOOH | Strong contextual and geo-fencing capabilities |

| MediaMath | Advanced programmatic teams | Supply path optimization (SOURCE), custom algorithms | Open web, mobile, video, CTV | Flexible data onboarding and integrations |

Leading Supply-Side Platforms (SSPs) for Publishers

While advertisers use DSPs, publishers use SSPs to sell their ad space. Understanding the key players on the supply side provides a more complete picture of the programmatic landscape.

These platforms help websites and app owners maximize their ad revenue.

Google Ad Manager

Programmatic publishers utilize an average of 6 SSPs to sell ad space to advertisers. Despite this, Google remains the most popular SSP among publishers, claiming 51% of the industry’s market share.

In fact, 75% of ad impressions in the US come from Google Ad Manager.

Google Ad Manager exists for large publishers with significant direct sales. Some of the tools it offers include server-side header bidding, managed PMPs, advanced dashboard and reporting system, and more.

- Supported Ad Inventory: Video, mobile, display, and native.

- Anti-fraud/Safety Measures for Publishers: Google supports popular safety standards, initiatives, and protocols such as the IAB ads.txt standard, SafeFrame, and HTTPS to protect against unsuitable ads and invalid activity

PubMatic

PubMatic offers services for both media buyers and publishers. As an SSP, it provides an impressive collection of tools to help publishers optimize the monetization potential of all their digital assets.

This includes tools for header bidding, RTB advertising, Private Marketplaces (PMP), and ad quality.

- Supported Ad Inventory: CTV, OTT, display, video, addressable, mobile, native, and more

- Anti-fraud/Safety Measures for Publishers: Uses real-time scanning and strategic partnerships to safeguard publisher’s audiences across ad formats, channels, and screens

Magnite

Magnite, formerly known as Rubicon Project, is one of the leading SSP for inventory monetization across CTV, video, display, and mobile environments. It connects premium media owners with top-tier demand sources through real-time auctions and programmatic deals.

Magnite is strongly focused on connected TV and video monetization. The platform is purpose-built to handle the complex needs of CTV publishers, offering advanced tools for ad podding, ad frequency capping, and audience segmentation.

For advertisers looking to scale high-quality video and CTV campaigns while maintaining control and transparency, Magnite serves as a critical part of the programmatic supply chain.

- Supported Ad Inventory: CTV, OTT, desktop and mobile display, mobile in-app, video, native; strong in premium video and publisher-direct inventory

- Anti-fraud/Safety Measures for Publishers: Offers pre-bid and post-bid protections, ads.txt and sellers.json compliance, integration with third-party verification; also supports traffic filtering and auction-level transparency

Top Data Management Platforms (DMPs) to Enhance Targeting

DMPs are the data engines of the programmatic world. They aggregate first-party data (from your website/CRM), second-party data (from partners), and third-party data (from data brokers). This consolidated data is used to create rich audience segments for more effective targeting.

Salesforce Audience Studio

Salesforce Audience Studio is an enterprise-grade DMP deeply integrated with Salesforce Marketing Cloud and Salesforce CRM. It focuses on unifying customer data across marketing, sales, and service systems to create a persistent customer profile for activation across channels.

Core capabilities include cross-channel data ingestion, real-time segmentation, and audience activation across DSPs and social platforms. Its tight CRM integration makes it especially valuable for B2B and lifecycle-based targeting.

- Primary Focus: Enterprise customer data unification and activation.

- Data Sources Supported: Web, mobile, CRM, email, offline, partner data.

- Identity Capabilities: CRM-based identity resolution and profile unification.

- Activation Channels: DSPs, social platforms, email, onsite personalization.

- Best For: Organizations aligning advertising with CRM and lifecycle marketing.

Lotame

Lotame is a leading independent DMP with a strong global data marketplace. It enables marketers, agencies, and publishers to collect first-party data, enrich it with third-party data, and activate audiences across programmatic and direct channels.

Lotame is recognized for its privacy-first identity solution, Panorama ID. This provides a cookieless identifier designed to support audience targeting and measurement in environments where third-party cookies are unavailable.

- Primary Focus: Flexible data collection and cookieless identity.

- Data Sources Supported: Web, mobile, partner data, third-party marketplace.

- Identity Capabilities: Panorama ID cookieless identity framework.

- Activation Channels: DSPs, SSPs, CTV platforms, direct publisher deals.

- Best For: Advertisers and publishers preparing for a cookie-less ecosystem.

Oracle BlueKai

Oracle BlueKai is part of Oracle Advertising and Customer Experience Cloud. It combines one of the largest third-party data marketplaces with enterprise-grade data management and segmentation capabilities.

BlueKai allows organizations to enrich first-party data with large-scale third-party attributes, build advanced audience segments, and activate them across Oracle’s ad ecosystem and external DSPs. It is widely used in large-scale consumer advertising programs.

- Primary Focus: Third-party data enrichment and large-scale segmentation.

- Data Sources Supported: CRM, site data, offline data, third-party marketplace.

- Identity Capabilities: Oracle ID graph and cross-device mapping.

- Activation Channels: Oracle DSP, external DSPs, onsite personalization.

- Best For: Enterprises running high-volume, data-enriched campaigns.

How to Choose the Right Programmatic Advertising Platform

As you can see, programmatic platforms differ in inventory access, data infrastructure, pricing logic, and execution requirements. A mismatch between platform capabilities and internal readiness leads to inefficient spend, limited audience control, and fragmented measurement. A structured selection process reduces these risks and clarifies long-term fit.

Do not evaluate platforms on features alone. Assess how each platform supports your data strategy, measurement model, and operating capacity.

Step 1: Define Campaign Objectives and Measurement Requirements

Start with business outcomes. Programmatic technology should align with how performance is evaluated and optimized.

- For brand and reach objectives, prioritize platforms with broad video and CTV inventory, strong direct publisher integrations, and frequency management controls. These capabilities ensure predictable reach and reduce overexposure. Built-in brand safety and verification integrations are also essential to protect reputation at scale.

- For performance and revenue objectives, focus on conversion tracking depth, retargeting logic, and bid optimization tied to downstream outcomes. Some DSPs optimize only to platform-native events. Others allow custom conversion schemas or external attribution signals. This distinction affects how effectively campaigns learn from real business results.

At this stage, confirm how each platform handles attribution. If measurement remains limited to last-click or platform-contained events, cross-channel optimization will be constrained.

Step 2: Assess Your Budget and Pricing Models

Commercial models shape platform accessibility and long-term cost efficiency.

Most DSPs apply a percentage-of-media fee, CPM-based platform cost, or fixed licensing structure. Enterprise-grade platforms often enforce minimum monthly spend commitments or require managed service contracts. These conditions must align with your forecasted media investment and internal execution capacity.

Beyond headline pricing, review operational costs. Data onboarding fees, third-party data markups, verification costs, and managed service retainers can materially affect total ownership cost. Understanding these inputs early prevents budget surprises after onboarding.

Step 3: Evaluate Targeting Capabilities and Data Sources

Targeting effectiveness depends less on platform features and more on data maturity.

Assess how first-party data is onboarded from CRM systems, CDPs, and website events. Review identity resolution capabilities across devices and environments. Confirm audience refresh frequency and lookback windows to ensure recency in activation.

Third-party data access is widely available across DSPs. The differentiator is how audience logic is governed. Platforms that support reusable audience taxonomies, versioning, and auditability reduce manual rebuilding and minimize activation errors. Without this foundation, audience management becomes fragmented and difficult to scale.

Step 4: Analyze Inventory Quality and Brand Safety Features

Where will your ads appear?

Inventory quality directly impacts cost efficiency, reach consistency, and brand risk exposure.

Evaluate whether platforms rely primarily on open exchanges or maintain direct publisher and CTV supply relationships. Direct integrations often provide better transparency, improved bidding efficiency, and access to premium placements.

Supply Path Optimization tools are equally important. They allow teams to reduce redundant intermediaries, control fees, and improve win rates. Domain-level reporting and app transparency should be standard.

Brand protection remains non-negotiable. Look for integrated pre-bid filters, invalid traffic detection, and verification partnerships with IAS, DoubleVerify, or MOAT. Effective governance prevents ads from appearing in unsafe environments and reduces fraud-driven waste.

Step 5: Review Operating Model and Internal Readiness

DSP performance depends on execution maturity, not just technology.

Self-serve platforms provide granular control over bidding, targeting, and creative testing. They suit teams with in-house programmatic expertise and capacity for daily monitoring. Without this capability, performance can degrade quickly.

Managed service models shift execution to the platform’s trading team. This reduces internal workload but limits transparency and slows experimentation cycles. Understanding these tradeoffs upfront avoids misalignment after launch.

Also evaluate user experience, bulk-editing tools, automation features, training resources, and support SLAs. A steep learning curve or weak support structure increases operational risk during scaling.

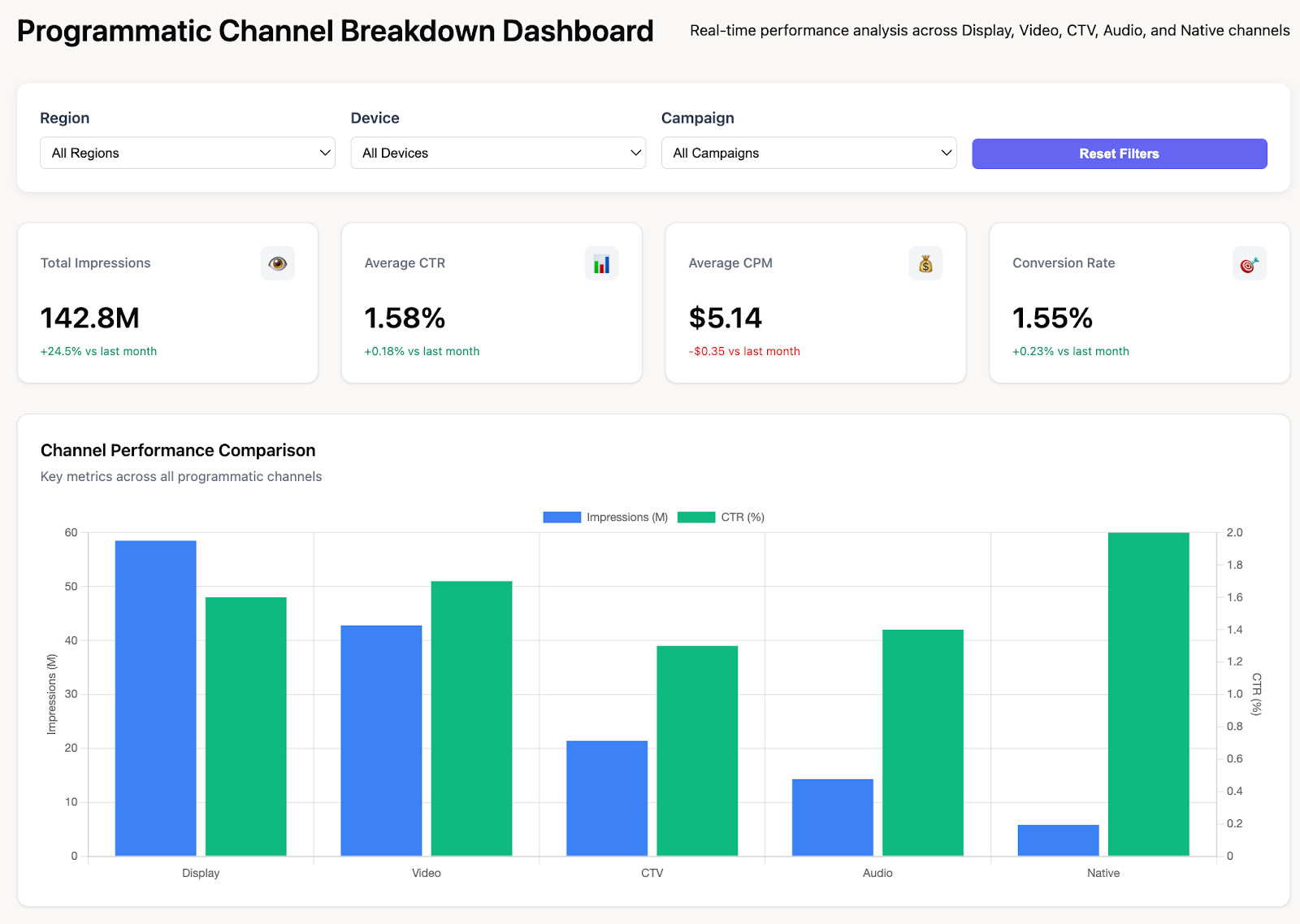

Step 6: Validate Reporting and Analytics Integration

Most DSPs offer strong in-platform dashboards but limited cross-channel visibility. This restricts budget allocation decisions and attribution accuracy.

Confirm whether log-level data, impression records, and conversion events can be exported or delivered directly into your data warehouse. Assess integrations with BI tools and support for custom attribution models. If reporting remains siloed, optimization will rely on partial performance signals rather than full-funnel outcomes.

Programmatic advertising generates high-volume, multi-platform data. Without a unified data foundation, audience activation, performance analysis, and attribution remain fragmented.

Improvado centralizes DSP, ad server, CRM, and revenue data into a governed warehouse layer. It standardizes naming conventions, metrics, and conversion schemas across platforms. Marketing teams receive analysis-ready datasets in BI tools or instant answers through AI Agent. This enables accurate cross-channel attribution, budget pacing, and ROI measurement without manual reporting pipelines.

Key Metrics for Measuring Programmatic Campaign Success

Launching a campaign is only the beginning. You must continuously measure performance to understand what works. Tracking the right metrics is essential for optimization and proving value. However, data from different platforms can be siloed, making a holistic view difficult. A proper ETL process is key to combining these data sources.

Top-of-Funnel Metrics: Awareness

- Impressions: Total ad exposures delivered. Used for scale and pacing control.

- Reach: Unique users exposed to ads. Used for audience coverage planning.

- Frequency: Average exposures per user. Used to prevent audience oversaturation.

- CPM (Cost Per Mille): Cost per 1,000 impressions. Benchmarks inventory and supply path efficiency.

- Viewability Rate: Percentage of impressions meeting viewability standards. Validates media quality.

- IVT Rate (Invalid Traffic): Percentage of impressions flagged as non-human or fraudulent. Measures inventory risk.

Mid-Funnel Metrics: Engagement

- CTR (Click-Through Rate): Percentage of impressions generating clicks. Signals creative and targeting relevance.

- VCR (Video Completion Rate): Percentage of completed video views. Evaluates video placement and content fit.

- Quartile Completion Rates: Video completion at 25%, 50%, and 75%. Identifies creative drop-off points.

- Interaction Rate: Engagement rate for rich media formats. Measures interactive ad performance.

- CPC (Cost Per Click): Average cost per click. Benchmarks traffic acquisition efficiency.

Bottom-of-Funnel Metrics: Conversion

- Conversions: Count of defined business outcomes (purchase, lead, signup).

- Conversion Rate (CVR): Percentage of clicks or impressions resulting in conversions. Indicates funnel efficiency.

- CPA (Cost Per Acquisition): Cost per conversion. Primary efficiency metric for performance campaigns.

- ROAS (Return on Ad Spend): Revenue generated per advertising dollar. Core profitability metric.

- CAC (Customer Acquisition Cost): Total marketing cost per acquired customer. Used for LTV comparison.

- Post-View Conversions: Conversions attributed to impression exposure without clicks. Important for CTV and display.

- Incrementality Lift: Conversion lift versus control groups. Validates true media impact.

Cross-Funnel and Optimization Metrics

- Supply Path Fees: Percentage of media cost lost to intermediaries. Used for SPO decisions.

- Bid Win Rate: Percentage of auctions won. Indicates bidding competitiveness.

- Effective CPM (eCPM): CPM adjusted for viewability and fraud filtering. Measures true media cost.

- Audience Match Rate: Percentage of onboarded users matched in the DSP. Indicates data activation quality.

- Attribution Model Comparison: Performance variance across attribution models. Guides measurement strategy.

Ultimately, a comprehensive view requires robust marketing analytics. You must be able to see how programmatic efforts influence the entire customer journey. This requires integrating data from your DSP with your web analytics, CRM, and other marketing channels.

Using advanced attribution models beyond last-click is also critical. This helps you understand the true value of each touchpoint in the path to conversion. Only a unified data approach can provide this level of insight.

Common Challenges in Programmatic Advertising (and How to Solve Them)

Programmatic advertising is powerful, but it is not without its challenges. Being aware of these potential pitfalls is the first step toward overcoming them. A proactive strategy is essential for navigating the complexities of the automated media landscape.

Ad Fraud and Viewability Issues

Ad fraud generates impressions and clicks from non-human traffic. Low viewability means ads technically served but never actually seen. Both distort optimization algorithms and inflate reported performance.

The solution is strict inventory quality enforcement. Require pre-bid fraud and viewability filters. Use third-party verification partners such as IAS, DoubleVerify, or MOAT. Prioritize buying on viewable impressions where available. Centralizing DSP and verification data in a unified reporting layer makes abnormal traffic patterns easier to detect and correct.

Attribution Blind Spots

Attribution can be a major challenge. Programmatic advertising platforms often play a role at the top or middle of the funnel, influencing purchases that get credited to other channels like search or social. Relying solely on in-platform last-touch attribution can undervalue your DSP efforts.

A unified attribution layer is required to close these blind spots, and this is where Improvado is commonly used. Instead of relying on channel-level, last-touch reports, Improvado centralizes DSP data with search, social, site analytics, and conversion data.

This makes it possible to analyze how upper- and mid-funnel exposure contributes to downstream conversions and revenue.

Improvado supports more accurate attribution by providing:

- Automated data ingestion from major programmatic advertising platforms, Google Ads, Meta, analytics tools, and CRMs

- Cross-channel entity and identity mapping to connect impressions, clicks, sessions, and purchases

- Standardized conversion and event schemas to align attribution logic across platforms

- Support for custom attribution models, including multi-touch, time-decay, and position-based approaches

- De-duplication of conversions to prevent double-counting across channels

- Warehouse-ready datasets for scalable attribution analysis

- Governed metric definitions to ensure attribution results remain consistent across teams

- BI and AI enablement to explore customer journeys and attribution outputs at scale

With this foundation, programmatic ads performance can be evaluated in context.

Marketers gain a clearer view of incremental impact, understand how DSP supports lower-funnel channels, and make budget decisions based on the full customer journey rather than isolated platform attribution.

Brand Safety Concerns

Brand safety risk occurs when ads appear next to inappropriate or non-compliant content. Single placement incidents can damage brand credibility and create regulatory exposure.

The solution is controlled placement governance. Apply pre-bid category and keyword blocking. Maintain updated inclusion and exclusion lists. Review domain- and app-level placement reports on a recurring basis. Consistent brand safety rules across all platforms prevent gaps in enforcement.

The Walled Garden Problem

Large platforms operate closed advertising ecosystems. They provide scale but restrict data extraction and cross-channel visibility. This limits attribution accuracy and makes budget allocation decisions dependent on partial performance data.

The solution is external data consolidation. Pull platform data into a neutral analytics environment. Standardize campaign naming and metric definitions across sources. Combine DSP, ad server, analytics, and revenue data into a single model. This enables cross-channel attribution and objective ROI comparison.

Navigating the Cookieless Future

Third-party cookies are being deprecated. Legacy tracking, retargeting, and user-level attribution methods lose reliability. Match rates decline and user journeys fragment.

The solution is first-party data and privacy-safe identity infrastructure. Strengthen direct data collection. Implement server-side event tracking. Activate cookieless identity frameworks such as UID2 and clean room integrations. Expand contextual and cohort-based targeting to maintain reach without relying on third-party cookies.

The Future of Programmatic Advertising: Trends to Watch

The programmatic industry is constantly evolving. Staying ahead of key trends is crucial for long-term success. The technology and strategies that work today will be replaced by more advanced methods tomorrow. Here’s what to prepare for.

The Rise of AI and Machine Learning

AI is moving from a buzzword to a core component of programmatic platforms. It's being used to power more sophisticated bidding algorithms, predictive audience modeling, and creative optimization. AI will automate more strategic decisions, allowing marketers to focus on higher-level planning. This evolution greatly impacts your final marketing ROI by increasing efficiency.

Growth in CTV and Digital Out-of-Home (DOOH)

Linear TV budgets are rapidly shifting to Connected TV. Programmatic platforms are the primary way to buy CTV ads, offering TV's impact with digital's targeting. Similarly, digital billboards and screens (DOOH) are becoming programmatically enabled. This opens up new, high-impact channels for automated buying.

The Shift Towards First-Party Data Strategies

As third-party cookies fade, your own first-party data becomes your most valuable asset. The ability to collect, manage, and activate customer data will be a key competitive differentiator. Platforms that offer secure data onboarding and "data clean room" functionalities will become increasingly important.

Enhanced Focus on Privacy and Transparency

Regulations like GDPR and CCPA are just the beginning. The industry is moving towards greater transparency in the supply chain and more user control over data. Advertisers will need to adopt privacy-enhancing technologies and be more transparent with consumers about how their data is used.

Conclusion

Choosing the right programmatic advertising platforms is a strategic imperative. It's a business decision that impacts your budget, brand, and growth. From understanding the core ecosystem of DSPs and SSPs to evaluating specific vendors like Google DV360 and The Trade Desk, the key is to align your choice with your unique goals and capabilities.

But a successful programmatic strategy requires more than just a good DSP.

It demands a unified view of performance across every channel and platform. Improvado provides the foundational data infrastructure to connect all your marketing data, enabling deeper insights and smarter, faster decisions. Take control of your data and unlock the true potential of your programmatic investment.

.png)

.png)