Insurance agencies face unique challenges in marketing analytics that demand specialized solutions.

- Disparate data sources—from CRMs and ad platforms to offline sales and agent interactions—make achieving a unified performance view both resource-intensive and error-prone.

- Complex buyer journeys, spanning multiple digital and offline touchpoints, complicate attribution and hinder precise campaign optimization.

- Lastly, calculating customer lifetime value (CLV) requires integrating data from renewals, claims, and cross-sell opportunities, often across siloed systems.

This guide showcases the top 5 insurance analytics software designed to address these specific challenges. Together, these tools create a synergistic approach, equipping insurance agencies with the capabilities to integrate data, establish business intelligence, refine performance analysis, and derive actionable insights for growth.

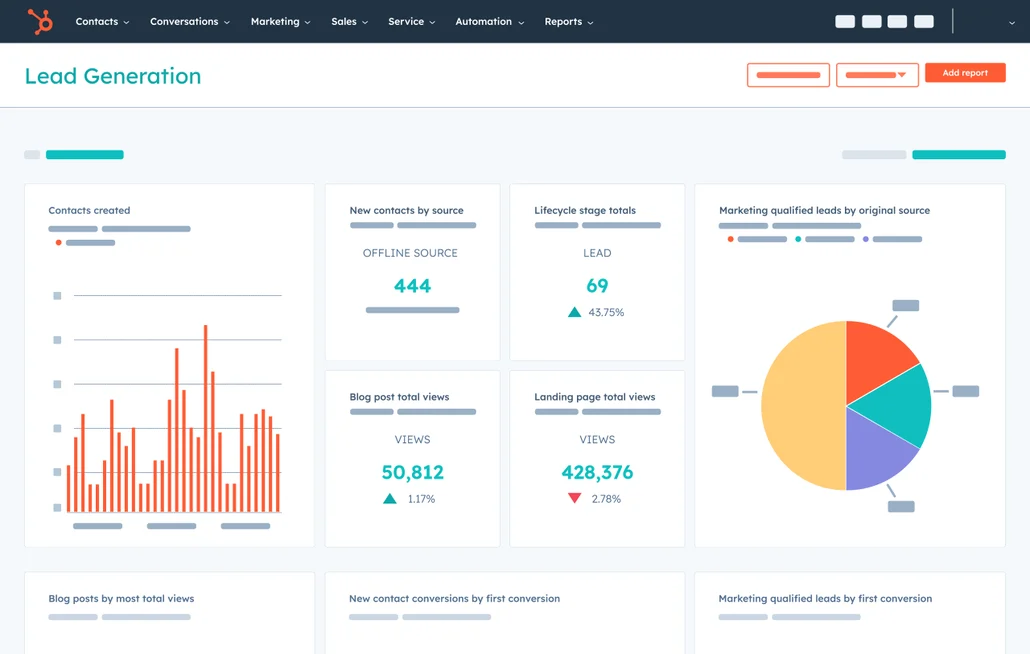

1. Hubspot

Best for: Lead management and customer engagement analysis and workflow automation.

Pricing: Starting at $15 a month.

G2 rating: 4.4

HubSpot is a marketing analytics and CRM platform that helps insurance companies manage and analyze their marketing efforts while improving customer relationships.

Key features:

- Marketing campaign analytics: Track metrics like click-through rates, conversion rates, and lead sources across email, ads, and social media campaigns. Insurance agencies can identify which campaigns drive the most policy inquiries and optimize efforts for maximum ROI.

- Lead tracking and scoring: With HubSpot, agencies can automatically track and score leads based on interactions like form submissions, quote requests, and website activity. For agencies managing multiple products (e.g., life, auto, and health), this ensures agents can prioritize leads with the highest conversion potential, reducing response times and increasing close rates.

- Email and workflow automation: Automate personalized email sequences to nurture leads through the sales funnel. For example, agencies can send renewal reminders or tailored policy offers based on customer behavior and preferences.

- Customizable dashboards: Build dashboards to monitor KPIs like policy applications, agent productivity, and campaign performance. The platform doesn’t provide any dashboard templates specifically for the insurance industry but agencies can customize pre-built dashboards to suit the specific needs.

- CRM integration: Connect marketing efforts with customer data in HubSpot’s CRM to track the entire customer journey, from acquisition to retention. This enables agencies to identify touchpoints that contribute most to policy sales and renewals.

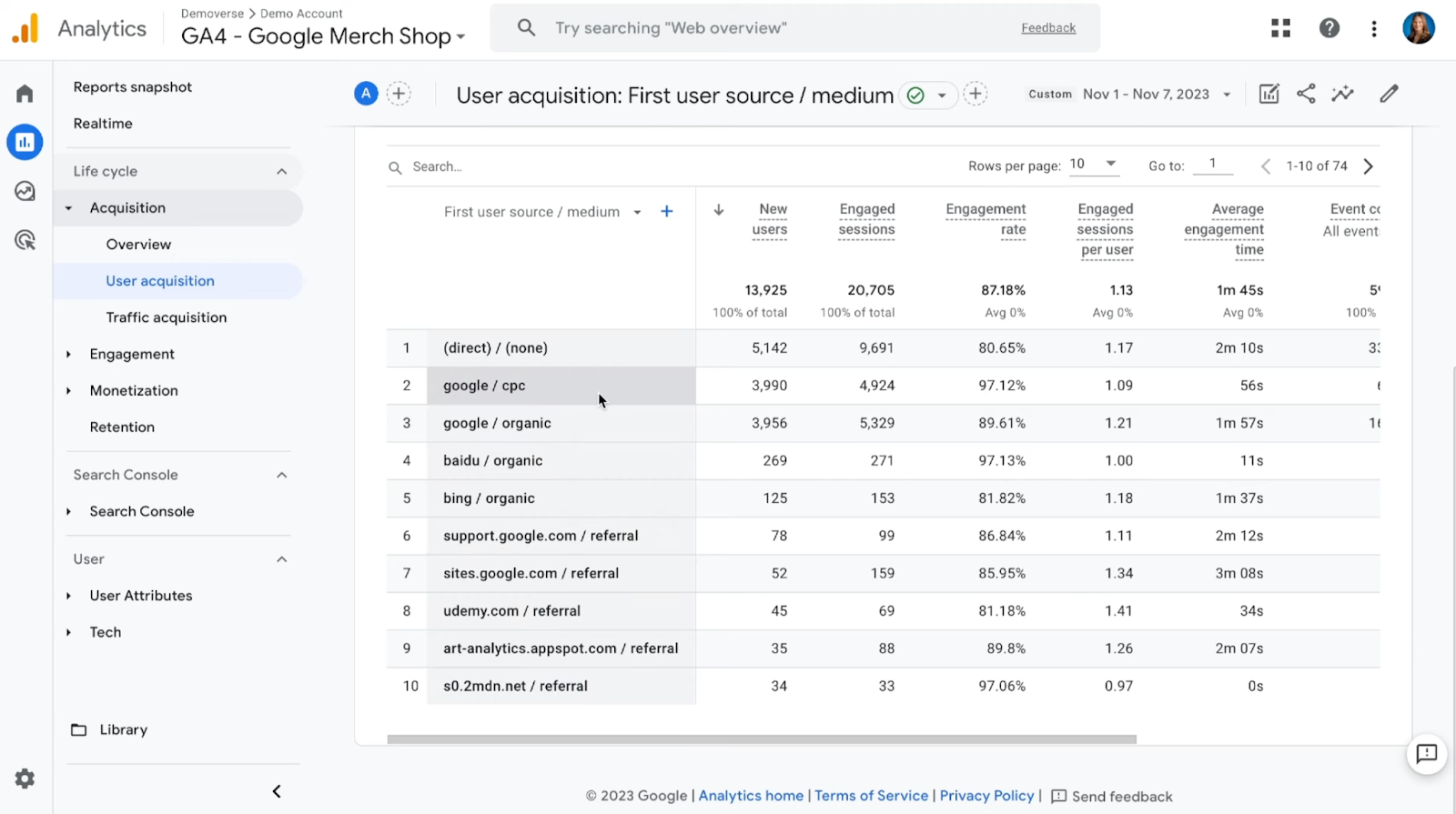

2. Google Analytics

Best for: Advanced web analytics and tracking customer interactions to optimize digital engagement.

Pricing: Free

G2 rating: 4.5

Google Analytics is a powerful tool for tracking and analyzing user interactions across digital platforms, helping insurance companies understand customer behavior and optimize their marketing efforts.

Key features:

- Custom conversion tracking: Google Analytics helps monitor high-value actions like policy quote requests, claims inquiries, and agent consultations. These metrics demonstrate the effectiveness of campaigns in driving critical conversions and reveal bottlenecks in the sales funnel.

- Cross-channel attribution: Track customer interactions across touchpoints like ad clicks, website visits, and agent contact forms. Identify which channels and campaigns are driving policy inquiries, such as auto insurance quotes or health plan applications, to better allocate resources.

- User behavior analysis: GA4 provides granular data about how potential policyholders interact with your site, from landing pages to exit points. These insights highlight user intent and help optimize website features to better guide customers through the decision-making process.

- Audience segmentation: Build targeted audience profiles based on rich demographic, geographic, or specific insurance needs (e.g., renters, homeowners, or business coverage). For instance, create segments for high-income policy seekers or users interested in specific insurance types, allowing for precision-targeted campaigns that drive conversions.

- Cross-device tracking: Combine user interactions from desktops, tablets, and smartphones into a single customer view. This feature is essential for understanding multi-device journeys, such as a user starting a quote request on mobile and completing it on a desktop.

- Integration with Google Ads: Link ad performance data with on-site behavior, such as completed quotes or policy applications, to evaluate the ROI of campaigns targeting high-value customer segments. This ensures ad budgets are spent on strategies that deliver the most valuable insurance leads.

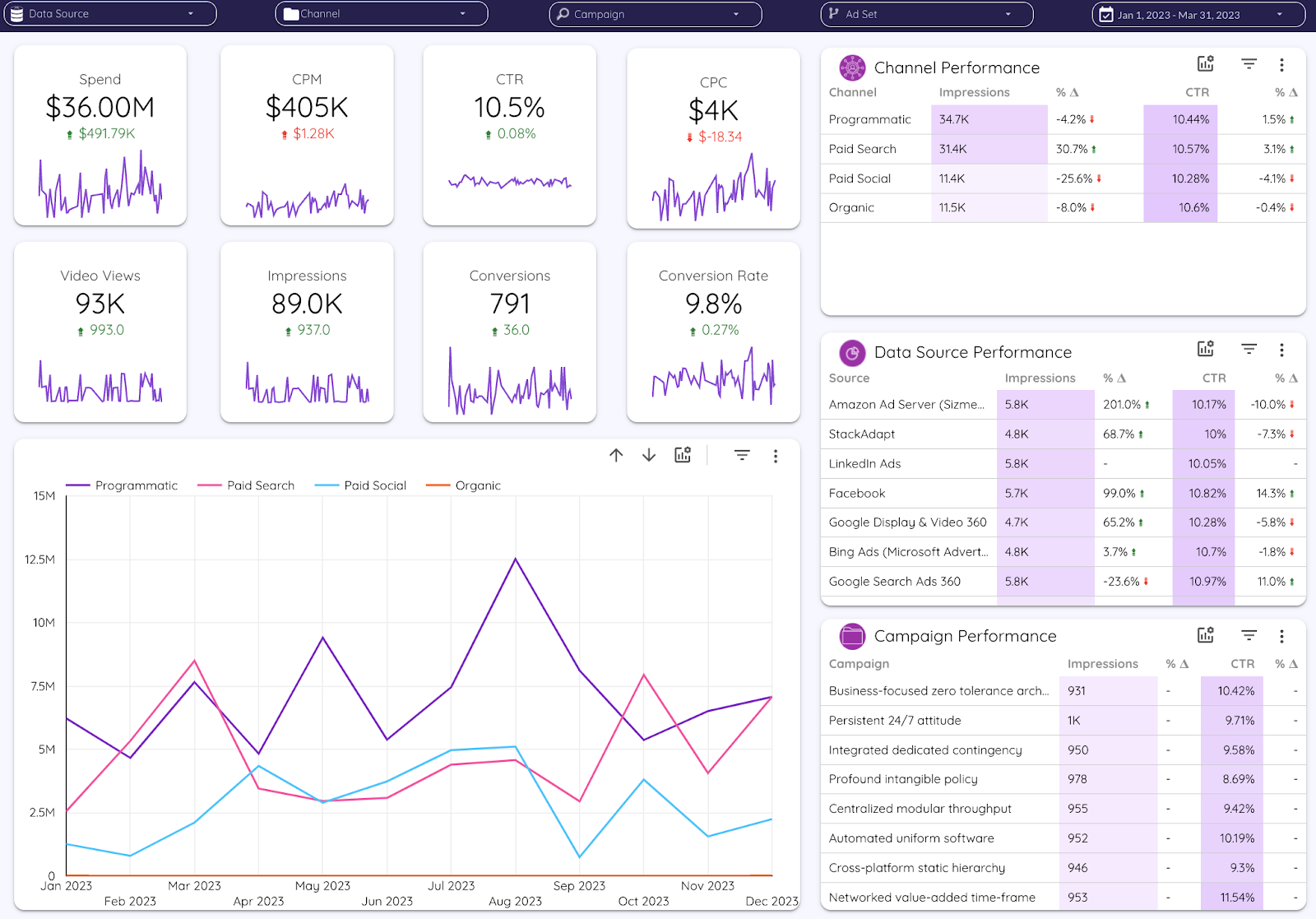

3. Improvado

Best for: Simplifying data management, improving performance visibility, and maximizing the efficiency of the marketing efforts.

Pricing: Custom pricing tailored to your needs, contact the team to request a quote.

G2 rating: 4.5

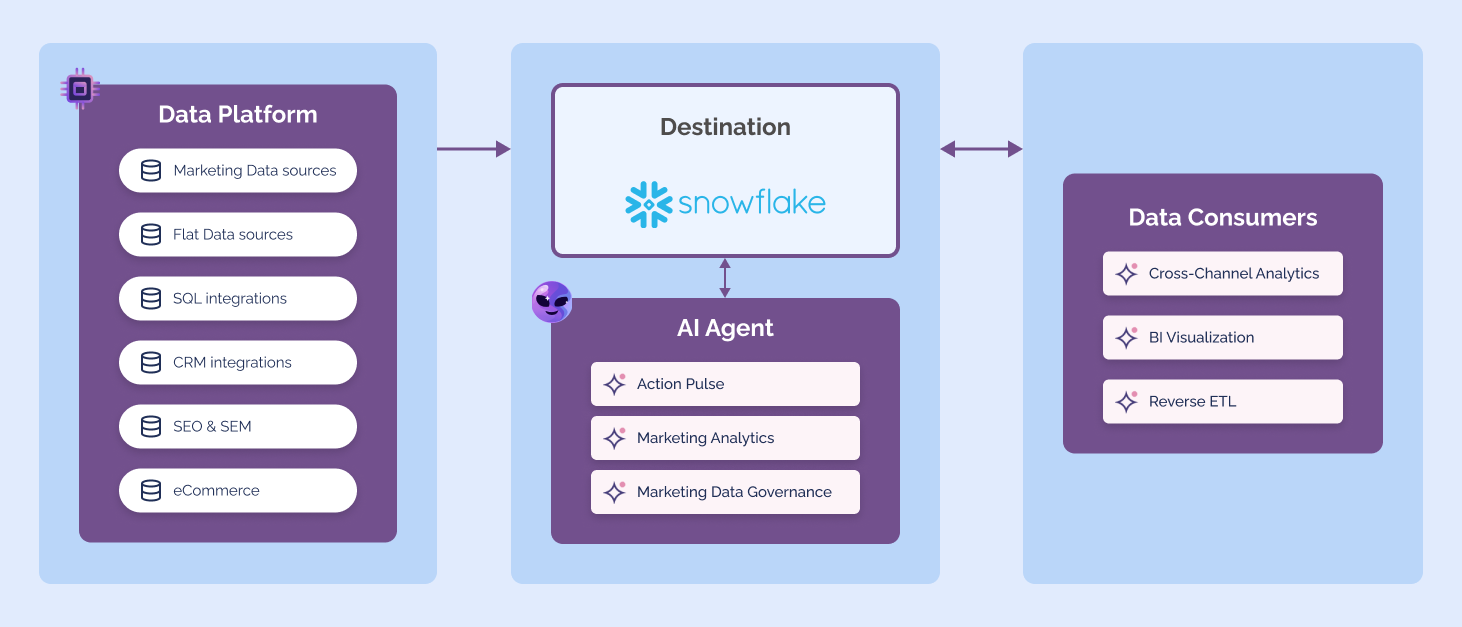

Improvado is a robust marketing analytics platform that empowers insurance companies to unify and analyze their marketing data across various channels and sources. Designed to streamline complex workflows, it provides automation, integration, and data-driven insights.

Key features:

- Centralized data integration: Improvado aggregates data from over 500 marketing and sales platforms, online, offline, and third-party data sources, including CRM systems, ad platforms, agency partners, and offline sales data from field agents. This means agencies can connect customer touchpoints from digital campaigns to agent-led interactions seamlessly and have a clear picture of ROI across all sales channels.

- Data transformation engine: Insurance agencies operate with highly fragmented data sources. Improvado harmonizes disparate data into a unified view with an advanced transformation framework, including AI Mapping in one click, blending data, grouping, and joining data. This enables seamless handling of complex analytics tasks and improves speed and accuracy of insights.

- Cross-channel attribution: Based on the aggregated data, Improvado helps insurance brands attribute conversions and revenue to marketing interactions using common single-touch, multi-touch, or custom attribution models.

- Scalable architecture: Improvado supports large volumes of data, making it suitable for enterprise-level insurance agencies managing complex campaigns across multiple regions and channels.

- Real-time performance tracking: Improvado provides a robust solution for marketing campaigns performance, brand safety, and data compliance tracking. It monitors adherence to pre-defined rules, paces metrics, and issues alerts for any anomalies, problems, or metrics drips.

- Customizable dashboards: Improvado provides pre-made dashboard templates for multiple marketing analytics use cases. Improvado’s Professional Service team can build a custom dashboard tailored specifically to your business goals.

- Regulatory compliance: Improvado is a HIPAA and GDPR compliant solution. The platform includes robust encryption, performs regular audits and assessments, which makes it a safe tool for agencies offering health, life, or disability products

4. Snowflake

Best for: Unifying fragmented data sources and data sharing between partners and departments.

Pricing: Usage-based pricing model, calculated based on compute, storage, and cloud services costs.

G2 rating: 4.6

Snowflake is a cloud-based data platform that empowers insurance companies to efficiently manage and analyze vast amounts of data, enhancing their marketing analytics capabilities. Its scalable architecture and advanced features enable insurers to derive actionable insights, streamline operations, and improve customer experiences.

Key features:

- Unified data platform: Consolidate data from policy details, claims processing, customer interactions, and marketing platforms into a single source of truth. This allows insurance agencies to analyze the entire customer lifecycle, from acquisition to retention, enabling a seamless view of customer behavior and campaign impact.

- Real-time data sharing: Access and share real-time datasets with partners, reinsurers, or third-party vendors to enrich customer profiles and enhance underwriting accuracy. Insurance companies can leverage these insights to create more personalized marketing campaigns and improve lead quality.

- Scalable data processing: Handle massive datasets from multiple channels with Snowflake’s scalable infrastructure to expand analytics capabilities. For example, insurers can efficiently process data from IoT devices, telematics, and call centers to refine predictive models and better understand customer risk profiles for targeted campaigns.

- Data security and compliance: Utilize built-in features like end-to-end encryption, role-based access controls, and automated compliance checks to safeguard sensitive policyholder data. These capabilities ensure compliance with industry regulations like HIPAA or GDPR, making Snowflake a safe choice for health and life insurance carriers.

- Advanced analytics integration: Integrate with machine learning tools to build predictive models for customer segmentation, churn analysis, and policy renewal likelihood. This helps insurers identify high-value prospects and tailor their campaigns to maximize ROI and customer satisfaction.

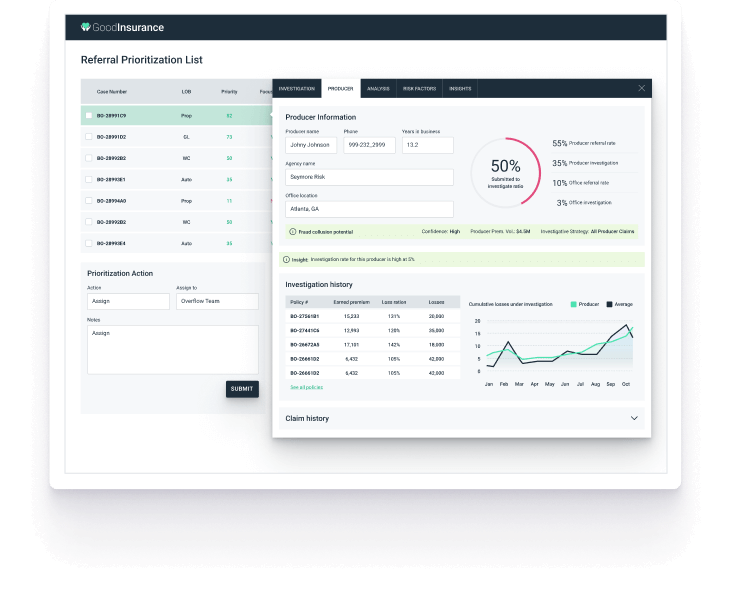

5. GoodData

Best for: Insurance data visualization and cross-functional analysis.

Pricing: Per-workspace, per-user, or custom pricing.

G2 rating: 4.1

GoodData is a more universal analytics platform that supports insurance companies in extracting valuable insights across all areas of operations, including marketing, underwriting, claims, and customer management.

Key features:

- Customizable dashboards: Use GoodData to build tailored dashboards to track KPIs like policy inquiries, lead conversions, and campaign ROI.

- Embedded analytics: GoodData allows brands to integrate analytics directly into customer-facing portals, agent platforms, or partner systems. For example, agents can access dashboards showing customer lifetime value, policy preferences, and claims history to provide more personalized policy recommendations and improve retention.

- Multi-source data integration: GoodData connects with multiple databases, allowing it to integrate data from CRM systems, marketing platforms, claims databases, and more into a unified analytics environment. However, before feeding data into GoodData, insurance companies must prepare and consolidate their data, as GoodData does not handle data preparation natively.

- Predictive analytics capabilities: GoodData provides machine learning models to forecast key trends, such as customer churn risks, renewal likelihood, or fraud probability. These insights enable insurers to implement proactive marketing strategies, such as targeted renewal reminders or anti-churn campaigns for high-value policyholders.

- Data governance and compliance: The platform is HIPAA and GDPR, offering features, such as role-based access controls and audit trails. This means health and life insurers managing PHI can securely use GoodData.

.png)

.png)