In the world of programmatic advertising, two names dominate the conversation: The Trade Desk (TTD) and Google's Display & Video 360 (DV360).

These platforms are the titans of the demand-side platform (DSP) landscape. They empower advertisers to purchase digital ad inventory across the web. However, they follow fundamentally different philosophies.

Choosing the right DSP is a critical decision. It directly impacts your campaign's reach, targeting precision, and overall return on investment. This guide provides a comprehensive breakdown of these platforms. We will dissect every feature to help you make an informed choice.

Key Takeaways:

- Core philosophy: DV360 is a "walled garden" powerhouse, deeply integrated with Google's services like YouTube and Search. The Trade Desk is an independent DSP focused on the open internet.

- Data & targeting: DV360 excels with Google's first-party audience data. TTD offers greater flexibility with third-party data providers and its UID2 identity solution.

- Inventory access: DV360 provides exclusive access to Google properties. TTD offers broader access to premium publishers, especially in Connected TV (CTV) and audio.

- Cost & transparency: TTD is known for its transparent fee structure but has high minimum spends. DV360's pricing can be more complex, bundled within the Google Marketing Platform.

- Ideal user: DV360 is ideal for advertisers heavily invested in the Google ecosystem. TTD is favored by large agencies and brands seeking omnichannel reach and data independence.

Understanding the Titans: What are The Trade Desk and DV360?

Before diving into a direct comparison, it's essential to understand each platform's identity. Both are demand-side platforms (DSPs). A DSP is a software system that allows buyers of digital advertising inventory to manage multiple ad and data exchange accounts through one interface.

Advertisers use DSPs to buy display, video, mobile, and search ads.

What Is Google Display & Video 360 (DV360)?

Display & Video 360 is an integrated tool for programmatic ad buying that is a part of the Google Marketing Platform. This suite includes tools like Campaign Manager 360, Search Ads 360, and Google Analytics 360. Its primary strength is its seamless integration with this ecosystem.

DV360 allows advertisers to plan campaigns, design creatives, organize audience data, and purchase inventory. It offers unique access to Google's owned and operated properties. This includes YouTube, Gmail, and inventory available through Google Ad Manager.

For advertisers already using Google Ads and Analytics, DV360 feels like a natural extension.

What Is The Trade Desk (TTD)?

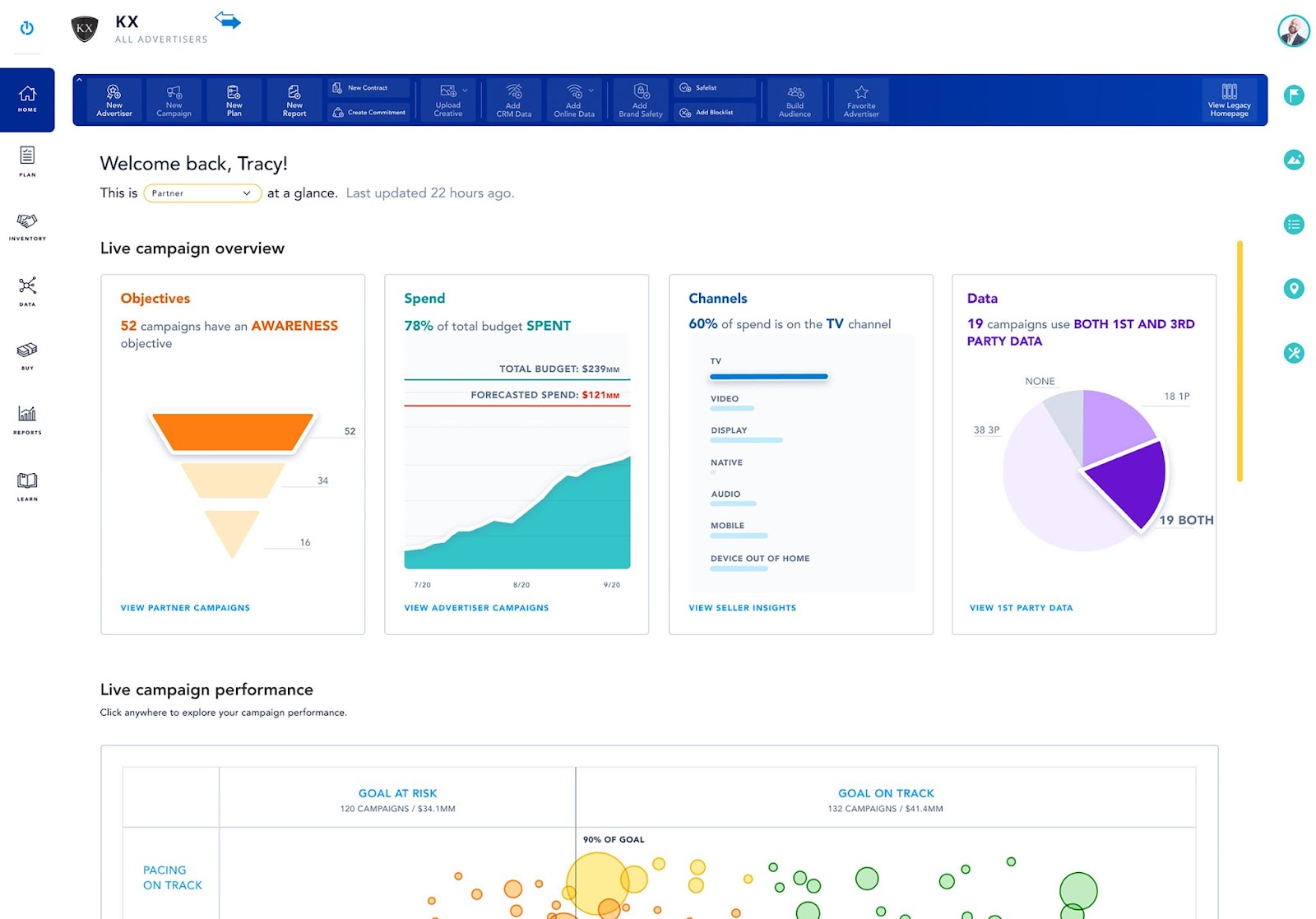

The Trade Desk is one of the largest independent DSPs in the world. It positions itself as an unbiased and transparent partner for advertisers.

Unlike Google, The Trade Desk does not own any media or content. This means it has no incentive to favor one publisher's inventory over another. Its goal is to provide advertisers with the best possible placements across the entire open internet.

TTD is known for its sophisticated technology and focus on omnichannel advertising. It offers robust tools for buying ads across display, video, audio, and emerging channels like Connected TV (CTV) and Digital Out-of-Home (DOOH).

It is a preferred choice for agencies and brands that demand control, flexibility, and broad market access.

Core Feature Deep Dive: Targeting and Audience Management

Targeting is the heart of programmatic advertising. DV360 and TTD approach this critical function from different strategic positions.

One leverages a colossal first-party data ecosystem. The other champions an open, flexible approach.

DV360's Reliance on the Google Ecosystem

DV360's primary targeting advantage is its access to Google's vast user data. This data is collected from services like Google Search, YouTube, Gmail, and Chrome. It allows advertisers to build highly specific audiences.

- Affinity audiences: Reach users based on their long-term interests and habits.

- In-market audiences: Target users actively researching or planning a purchase.

- Custom intent audiences: Create audiences based on specific keywords users have searched for on Google.

- Remarketing: Re-engage users who have interacted with your website or app, powered by Google Analytics 360 data.

This deep integration makes it incredibly powerful for targeting within Google's universe. However, this strength is also a limitation. The data is largely confined to Google's properties, creating a "walled garden" effect.

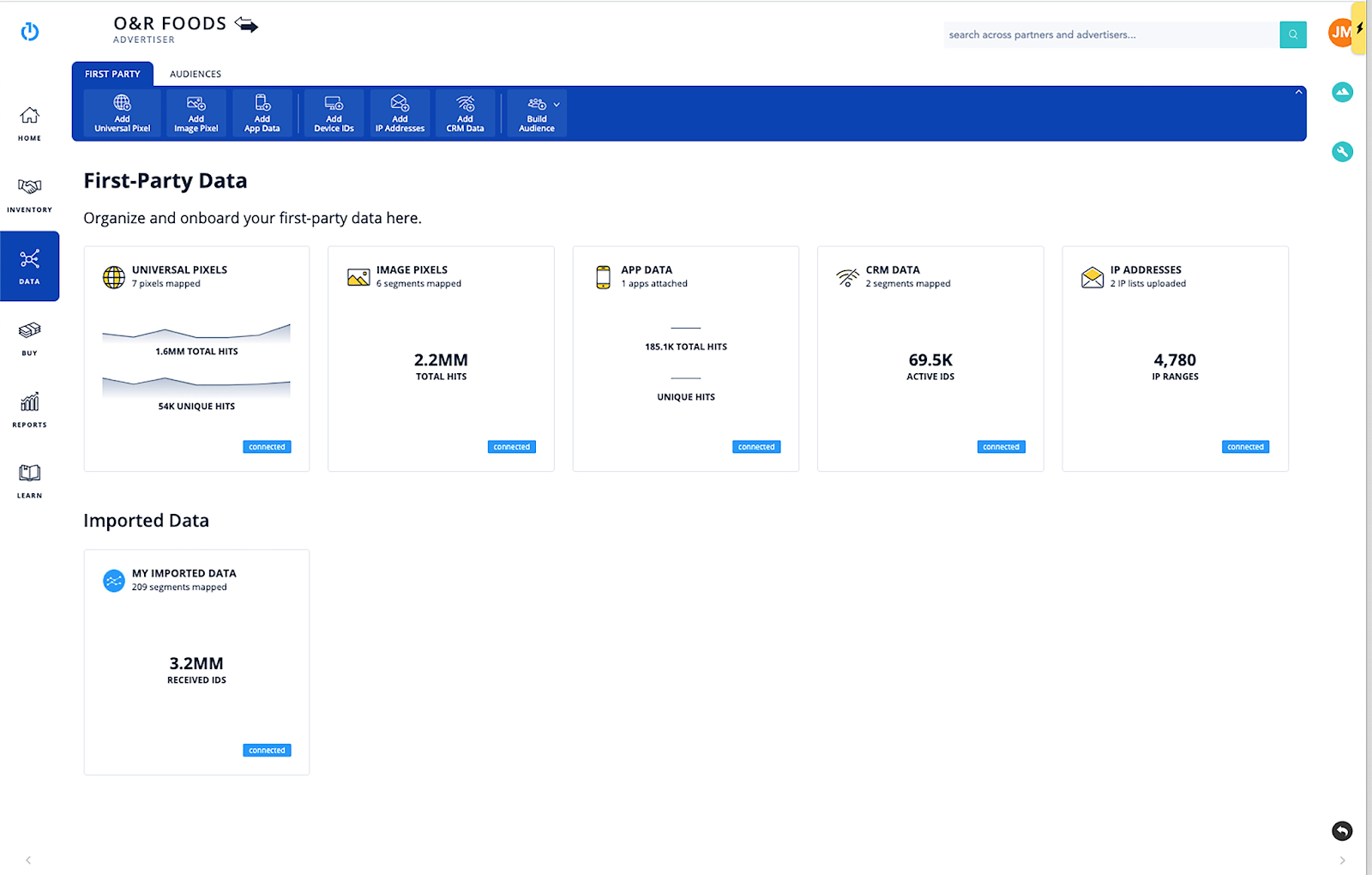

The Trade Desk's Open Approach to Data Integration

The Trade Desk offers unparalleled flexibility in data sources. It is not tied to a single data ecosystem. Instead, it allows advertisers to integrate data from a wide array of partners. This includes leading data management platforms (DMPs), data brokers, and retailers.

Advertisers can upload their first-party data (like CRM lists) and combine it with third-party data to create rich, custom audience segments.

This open model is powerful for advertisers who want to avoid vendor lock-in. It enables them to build a comprehensive view of their customers across the entire open internet, not just one ecosystem.

Identity Solutions: Privacy Sandbox vs. UID2

With the deprecation of third-party cookies, identity solutions are crucial.

DV360 is aligning with Google's Privacy Sandbox initiative. This approach uses browser-based APIs like Topics and FLEDGE to enable interest-based advertising without tracking individual users across sites. The effectiveness of this new model is still under evaluation.

The Trade Desk has spearheaded Unified ID 2.0 (UID2). This is an open-source framework that uses encrypted email addresses and phone numbers to create a common currency for identity. It aims to provide more precise targeting and measurement in a post-cookie world. UID2 has gained significant adoption among publishers and ad tech partners, presenting a strong alternative to Google's approach.

Creative Capabilities and Ad Formats: From Standard to Dynamic

Effective creative is just as important as precise targeting. Both DSPs offer robust tools for managing and deploying ad creatives across various formats. However, their approaches to dynamic optimization and creative development differ.

DV360's Integrated Creative Tools

DV360 benefits from its connection to the Google Marketing Platform. It integrates with Google Web Designer, a tool for building interactive HTML5 ads.

Its standout feature is dynamic creative optimization (DCO). DCO allows advertisers to create multiple versions of an ad from a single template. The platform then automatically serves the most relevant combination of headlines, images, and calls-to-action to each user based on their data. This is particularly powerful for retail and travel advertisers.

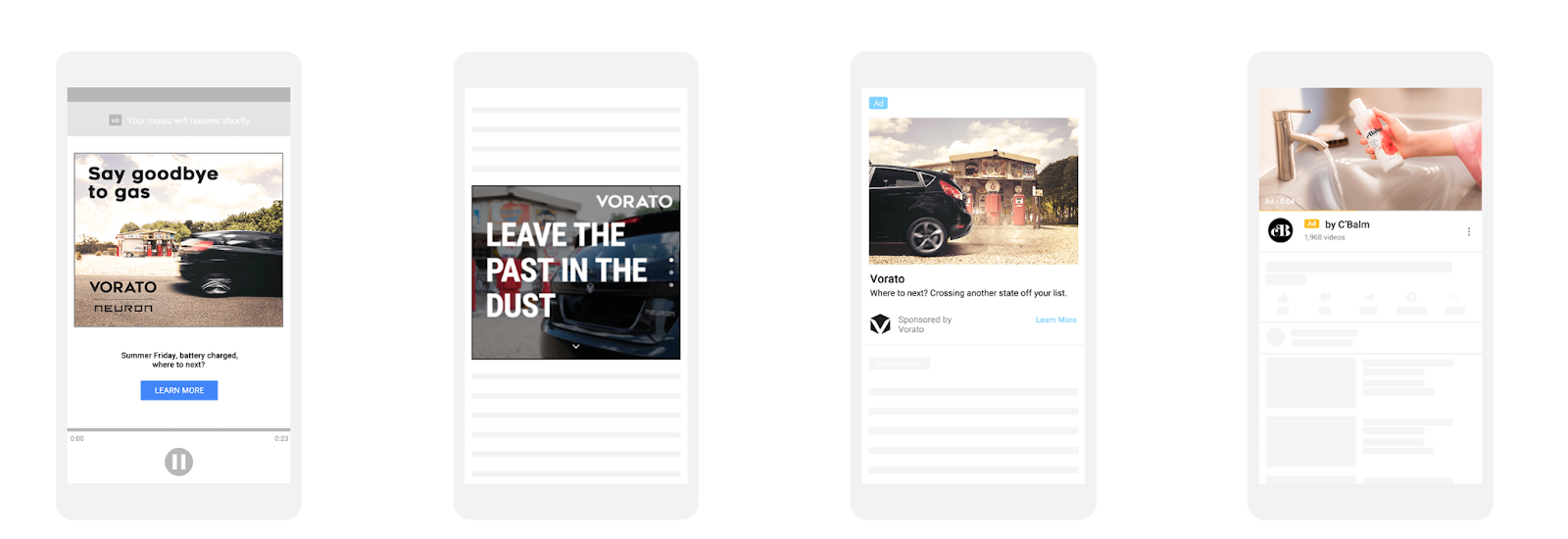

DV360 supports a wide range of formats, including standard display, rich media, and various video formats for YouTube and other video partners.

The Trade Desk's Flexible and Partner-Driven Approach

The Trade Desk also supports a broad array of ad formats. It is a leader in emerging channels like CTV, digital audio, and DOOH.

While it doesn't have a proprietary DCO tool as tightly integrated as Google's, it offers strong APIs. This allows for seamless integration with third-party creative management platforms (CMPs) and DCO specialists. This approach provides advertisers with more choices. They can select the best-in-class creative partner for their specific needs.

TTD's platform gives advertisers granular control over how and where their creatives are served. This transparency is a key selling point for agencies managing complex, multi-format campaigns.

Inventory Access and Quality: Walled Garden vs. Open Internet

A DSP is only as good as the inventory it can access. Here lies one of the most significant differences between DV360 and The Trade Desk. The choice between them often comes down to an advertiser's priority: deep access to one massive ecosystem or broad access to everything else.

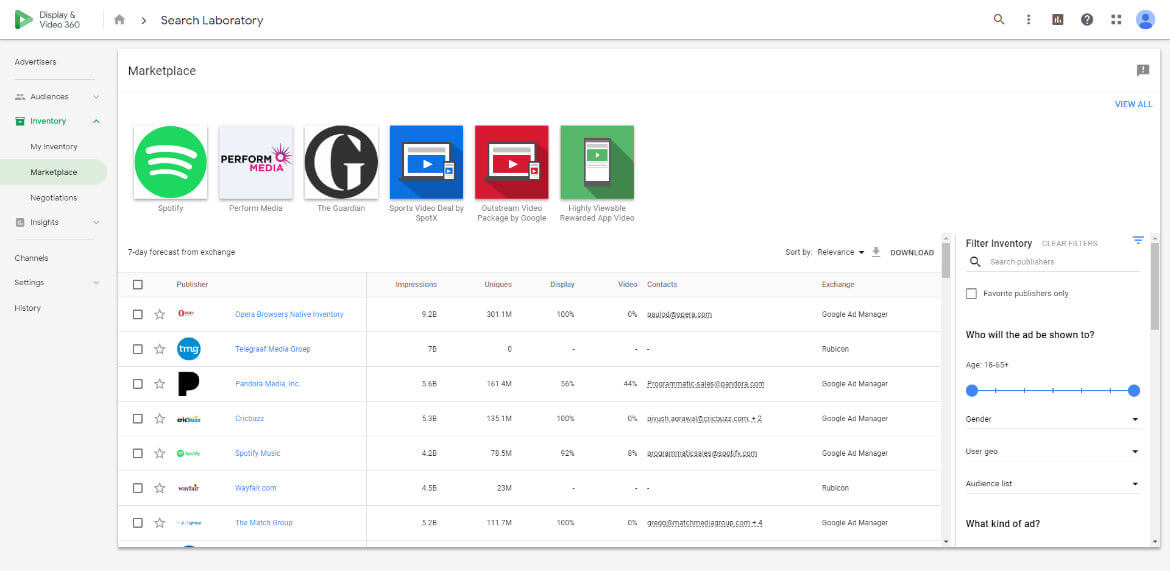

DV360: Exclusive Access to Google's Kingdom

DV360 is the primary programmatic gateway to Google's owned-and-operated inventory. This includes:

- YouTube: The world's largest video platform. DV360 offers unique access to YouTube's full range of ad formats, including TrueView, non-skippable ads, and masthead placements.

- Google Ad Manager: Access to a vast network of publisher sites that use Google's ad server.

- Gmail Ads: The ability to reach users directly in their inboxes.

While DV360 can also buy inventory on open exchanges, its main value proposition is this exclusive, high-quality Google inventory.

For advertisers where YouTube is a critical channel, DV360 is almost non-negotiable.

The Trade Desk: Champion of the Open Internet

The Trade Desk provides access to virtually every major ad exchange and supply-side platform (SSP). It has no allegiance to any single source of inventory. This allows it to offer advertisers a massive pool of options across display, mobile, and video.

Where TTD truly shines is in its premium inventory partnerships, particularly in fast-growing channels:

- Connected TV (CTV): TTD has direct integrations with nearly every major streaming service and TV network, making it a market leader in CTV advertising.

- Digital audio: It offers access to inventory from Spotify, Pandora, podcasts, and digital radio stations.

- Premium publishers: It has built strong relationships with top-tier publishers, offering curated marketplaces for high-quality, brand-safe inventory.

This focus on the open internet makes TTD the platform of choice for advertisers aiming for true omnichannel reach beyond Google's walls.

Pricing Models and Fee Structures: A Transparent Breakdown

Both platforms primarily operate on a percentage of media spend model, but the details and transparency levels vary.

DV360's Bundled Pricing Model

DV360's pricing can be more opaque. The platform fee is often bundled with other services within the Google Marketing Platform. Typically, advertisers can expect to pay a percentage of their media spend, often ranging from 10% to 15%.

However, additional costs can apply:

- Ad serving fees: If using Campaign Manager 360 to serve ads, there are separate CPM-based fees.

- Data costs: Using third-party audience segments incurs additional data CPM fees.

- Advanced features: Tools like advanced attribution modeling may come with extra charges.

The total cost can be difficult to itemize, as it is part of a larger platform agreement. This simplicity can be appealing, but it reduces transparency.

The Trade Desk's Transparent Fee Structure

The Trade Desk is renowned for its transparency. Its business model is built on being an unbiased partner. The platform fee is a clear percentage of media spend, typically around 15-20%.

All other costs are passed through to the advertiser at cost and clearly itemized:

- Media cost: The actual price paid for the ad impression.

- Data cost: Any fees for third-party data are listed separately.

- Feature costs: Fees for optional features like cross-device targeting or lookalike modeling are opt-in and explicitly charged.

This transparency is highly valued by agencies. However, TTD has very high minimum spend requirements. These can range from $100,000 to over $1 million per quarter, making it inaccessible for small and medium-sized businesses.

Analytics, Measurement, and Reporting: Uncovering Performance Insights

Data-driven optimization requires robust analytics. Both DSPs provide powerful reporting suites, but their capabilities are shaped by their underlying ecosystems. Analyzing this data often presents data integration challenges that can be solved with the right tools.

DV360: Deep Integration with Google Analytics

DV360's reporting strength is its native integration with Google Analytics 360 (GA360). This allows advertisers to connect their ad spend data directly with website behavior and conversion data. They can see how programmatic campaigns influence the entire customer journey. This provides a holistic view for advertisers already embedded in the Google stack.

The platform also offers advanced measurement tools like Brand Lift studies for YouTube campaigns. This helps quantify the impact of video ads on brand awareness and consideration. Building a comprehensive marketing data pipeline from DV360 into a central repository is key for deeper analysis.

The Trade Desk: Granular, Cross-Channel Reporting

The Trade Desk offers extremely detailed and customizable reporting. Its platform provides log-level data, giving advertisers access to the raw data behind every impression. This level of granularity is a significant advantage for sophisticated advertisers and agencies who want to conduct their own analysis.

TTD's reporting excels at cross-channel measurement. It can show how exposure on CTV, audio, and display work together to drive conversions.

To truly leverage this, many advertisers use an ETL process to load TTD data into a data warehouse alongside other marketing sources. This enables the creation of powerful KPI dashboards that visualize performance across the entire marketing mix. For many, this requires automated reporting to manage the scale of data.

Attribution Modeling

Both platforms offer various attribution models.

DV360 includes Google's data-driven attribution, which uses machine learning to assign credit across touchpoints.

TTD provides a range of standard models and allows for more custom analysis due to its log-level data access.

For true cross-platform insights, advertisers need attribution models that incorporate data from both DSPs as well as paid search, social, retail media, CRM, and downstream revenue systems. This is where most teams hit a wall. Platform-reported attribution is isolated, inconsistent, and biased toward its own inventory.

Improvado solves this by centralizing and preparing data from DV360, TTD, and 500+ other marketing and revenue platforms. It creates a single, governed dataset that attribution models can use without manual cleanup or cross-platform reconciliation.

Improvado handles the heavy lifting:

- Unified data ingestion from DV360, TTD, search, social, programmatic, CRM, and revenue systems

- Normalization and metric standardization so impressions, clicks, conversions, and costs align across platforms

- Entity resolution that stitches campaigns, audiences, and placements into a common structure

- Time-series alignment to synchronize touchpoints across channels and customer journeys

- Attribution-ready schemas that feed advanced models with clean, consistent inputs

With this foundation, teams can build custom attribution models that outperform any platform-specific solution. Whether you need multi-touch attribution, algorithmic modeling, geo-based incrementality testing, or hybrid approaches, Improvado provides the reliable data layer these methods require.

The result is a measurement system that reflects your customer journey, not a fragmented view dictated by walled gardens.

The Ultimate Comparison: DV360 vs. The Trade Desk

To simplify the decision-making process, here is a head-to-head comparison of the key features and attributes of each platform.

| Aspect | Google Display & Video 360 (DV360) | The Trade Desk (TTD) |

|---|---|---|

| Core Philosophy | Integrated part of the Google "walled garden" ecosystem. | Independent, unbiased platform for the open internet. |

| Primary Inventory | Exclusive access to YouTube and Google properties. | Broad access to open exchanges, premium publishers, CTV, and audio. |

| Audience Data | Leverages Google's first-party search, YouTube, and browser data. | Flexible integration with first-party and third-party data providers. |

| Identity Solution | Google's Privacy Sandbox (Topics API, FLEDGE). | Unified ID 2.0 (UID2) and other open-source identifiers. |

| Creative Tools | Integrated with Google Web Designer; strong native DCO capabilities. | Flexible API for integration with third-party creative platforms. |

| Pricing Transparency | Can be opaque; fees are often bundled within the GMP stack. | Highly transparent; fees are itemized and passed through. |

| Minimum Spend | More accessible, especially for GMP customers. No hard minimums. | Very high, often requiring $100k+ per quarter. |

| Best For | Advertisers heavily invested in Google's ecosystem, especially for YouTube. | Large agencies and brands seeking omnichannel reach and data independence. |

The Strategic Choice: Which DSP is Right for Your Business?

The "better" platform does not exist in a vacuum. The right choice depends entirely on your business goals, budget, target audience, and existing technology stack.

Choose DV360 if:

- YouTube is a primary channel for you. DV360's exclusive access and targeting capabilities on YouTube are unmatched.

- You are already heavily invested in the Google Marketing Platform. The seamless integration with GA360, Search Ads 360, and Campaign Manager 360 creates powerful efficiencies.

- You want to leverage Google search intent data for programmatic display and video. The ability to target users based on their Google searches is a unique and powerful feature.

- You have a smaller budget. DV360 is generally more accessible to businesses that don't meet TTD's high minimum spend requirements.

Choose The Trade Desk if:

- You want to avoid vendor lock-in and prioritize the open internet. TTD's independence ensures its recommendations are unbiased.

- Connected TV (CTV) and digital audio are key parts of your strategy. TTD is the market leader in these emerging channels, with superior inventory and measurement.

- Data flexibility and control are paramount. You want to integrate multiple data sources and have granular control over your audience strategy.

- You are a large agency or enterprise brand with a significant budget. You can meet the minimum spend requirements and have the resources to leverage its advanced features.

- You demand full transparency in your media buys. TTD's clear, itemized fee structure provides complete visibility into where your money is going.

Conclusion

The debate between The Trade Desk and DV360 is not about which platform is definitively superior. It is about which platform aligns best with your advertising strategy.

DV360 offers the power and convenience of a deeply integrated, data-rich ecosystem. It is an undeniable force for any advertiser focused on Google's vast properties.

The Trade Desk provides freedom, flexibility, and a transparent window into the entire open internet. It empowers sophisticated advertisers to build truly omnichannel campaigns.

Many large advertisers ultimately use both platforms. They leverage DV360 for its unique access to YouTube and Google audiences. They use The Trade Desk for its expansive reach across CTV, audio, and premium open web publishers.

.png)

.png)