Allocating a marketing budget is not an administrative task — it is a strategic process that shapes business growth. In volatile markets, every dollar must prove its value. Teams are under pressure to achieve more with fewer resources, making disciplined, data-driven investment essential. Effective allocation relies on accurate data, automated reporting, and clear governance to ensure each spend directly supports measurable outcomes. This guide outlines how to design and manage budgets that adapt to change, use data to prioritize the right channels, and turn marketing investment into defensible, repeatable ROI.

According to eMarketer, worldwide ad spending is set to top the $1T mark in 2026, with digital accounting for more than 75% of total media spend – underscoring why allocation decisions matter more than ever. Multiple forecasters converge on continued growth: Dentsu projects ~4.9% global ad spend growth in 2026.

What is a Marketing Budget?

At its core, a marketing budget serves three strategic purposes:

- Resource allocation: Ensures balanced investment across paid, organic, events, partnerships, and other channels based on expected ROI.

- Performance measurement: Connects spend to KPIs such as customer acquisition cost (CAC), lifetime value (LTV), and pipeline contribution to track efficiency and profitability.

- Strategic agility: Enables real-time budget adjustments through reporting and forecasting, redirecting spend toward high-performing channels, campaigns, or regions.

Why is Effective Marketing Budget Allocation Crucial?

The logic seems clear – better budget management leads to stronger returns on every dollar spent. Yet the value extends well beyond ROI. Strategic budget allocation drives alignment, agility, and accountability across teams and markets.

- Aligns spend with strategic growth objectives: A structured budget standardizes spend tracking across business units and markets. It links every investment directly to revenue goals, ensuring finance, sales, and marketing work toward shared outcomes rather than in silos.

- Maximizes ROI through attribution and performance insights: Data and operations leaders must prove which campaigns generate real revenue. Allocating budgets through attribution models and multi-touch insights prevents waste and optimizes investment across acquisition, paid media, and retention programs.

- Supports agility in dynamic markets: Marketing leaders face constant change – new platforms, shifting buyer behavior, and evolving competition. A flexible budget structure allows rapid reallocation mid-quarter without losing visibility into long-term performance.

- Improves accountability and forecasting accuracy: Budgets tied to KPIs such as CAC, LTV, and pipeline contribution act as forecasting tools, not expense trackers. They strengthen quarterly planning and board-level reporting with measurable financial alignment.

- Enables data-driven execution: Centralized spend data connected to performance dashboards gives teams real-time visibility. Operations can reallocate resources precisely, while executives track marketing’s direct impact on growth, not just activity.

How to Create Your Marketing Budget in 7 Steps?

Creating a marketing budget at enterprise scale requires strategic alignment and disciplined planning. It connects business objectives to measurable outcomes and guides investment decisions across all channels. Effective budgets rely on data-driven insights and precise resource allocation to ensure accountability and impact. Leaders must achieve more with fewer resources, making structured frameworks essential for maximizing ROI and earning C-suite confidence. This guide outlines seven steps to build a marketing budget that supports agility, precision, and sustainable growth.

Step 1: Align with goals

The first step in marketing budgeting is aligning every plan with the company’s strategic goals. Budgets must directly support business objectives such as revenue growth, market expansion, product launches, or customer retention. Alignment ensures every marketing dollar contributes to a measurable business outcome and prevents teams from spending in isolation without clear impact. If the company targets rapid growth or new markets, marketing must expand budgets for awareness and lead generation campaigns. Tying investments to strategic goals builds accountability, clarity, and stronger business performance.

Step 2: Define audience and journey

Next, clearly define your target audience and customer journey. In an enterprise, this often means multiple segments or buyer personas across different markets.

Defining the customer journey is especially crucial as buying behavior continues to evolve. Studies in 2024 showed that B2B buyers are taking longer to make decisions and often remain anonymous and self-directed for most of the process.

These savvy buyers conduct independent research online, consuming content and reviews before ever talking to a rep. For marketing, this means budgets should ensure coverage of the entire digital journey – from early-stage educational content (to grab those anonymous researchers) to mid-funnel nurturing (email, retargeting ads) and post-demo acceleration.

Step 3: Audit spend and performance

Before finalizing where new budget dollars will go, take a hard look at past spend and performance.

The goal is to identify what works, what doesn’t, and how past investments have paid off. This data-driven review prevents the blind repetition of last year’s budget allocations. For instance, analyze each major channel and campaign from the past year: How much was spent, and what was the return (in leads, sales, or other KPIs)?

Auditing past performance matters because it grounds your budget in evidence. You’re essentially learning from last year’s wins and losses to invest smarter this year.

Step 4: Determine total budget

With goals set, an audience defined, and past performance in mind, you can now determine the total budget needed for your marketing efforts.

The total marketing budget for an enterprise is typically influenced by factors such as company size, industry, growth targets, and revenue. One common approach is to frame the marketing budget as a percentage of the company’s revenue. Recent benchmarks can help guide this decision. Gartner’s 2026 CMO Spend Survey shows average marketing budgets holding around 7.7% of company revenue year over year. For historical context, Gartner reported 9.5% in 2022 before the subsequent decline—useful when explaining year‑over‑year shifts to finance.

In the next section, we will delve into the details of how much a company can and needs to spend on marketing.

Step 5: Choose budgeting model

With a total budget range in mind, the next step is deciding how to allocate and justify spending. Selecting the right budgeting model ensures marketing investments align with your company’s strategy, planning style, and financial structure. Many enterprises use a hybrid approach to balance flexibility and accountability. Below are the most common budgeting models.

- Percentage of Revenue: This top-down model links marketing spend to a fixed percentage of projected revenue (for example, 8% of next year’s gross revenue). It scales naturally with company size and provides simplicity for finance alignment.

- Competitive Parity: This approach benchmarks your budget against competitors’ spending to maintain or grow share of voice. It helps companies in competitive markets avoid underinvestment but does not always guarantee efficient use of funds.

- Objective-Based (Task-Oriented): This bottom-up model builds the budget around specific marketing objectives or campaigns. You list the initiatives required to reach each goal and estimate their costs. For example, generating 1,000 enterprise leads may include LinkedIn ads, events, and content series – the total of these costs defines the required budget.

- ROI-Based: A data-driven model that allocates funds to high-performing channels or campaigns with proven returns. It maximizes ROI and appeals to finance teams, though marketers should also reserve funds for long-term brand growth or innovation efforts with delayed payback.

- Zero-Based Budgeting (ZBB): This model starts every cycle from zero, requiring each expense to be justified as new. ZBB eliminates “auto-pilot” spending and ensures lean, efficient budgets but demands significant time and analysis to build from scratch annually.

Choosing the right model depends on company maturity, data availability, and leadership expectations. Many enterprise teams combine these approaches to balance efficiency, growth, and agility.

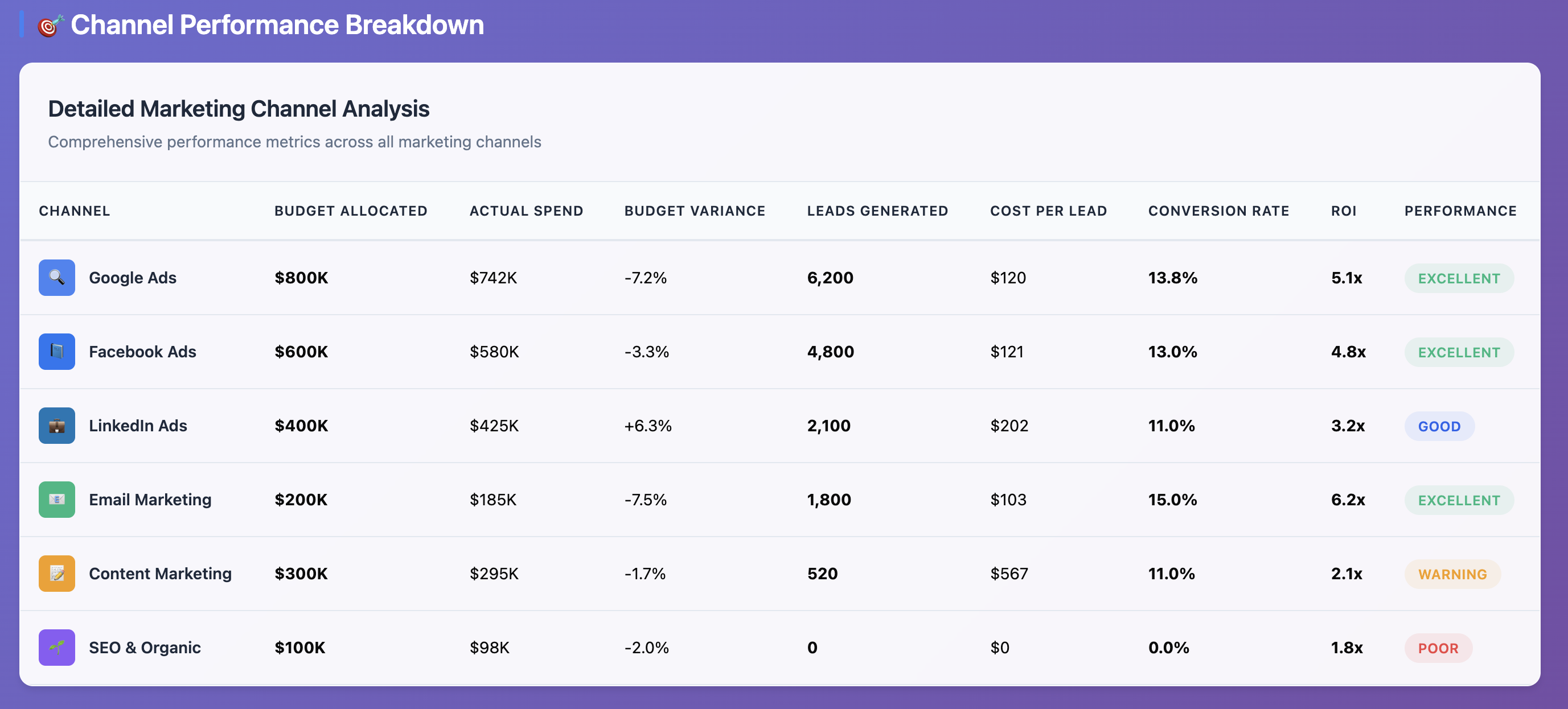

Step 6: Allocate across channels

Once you have finalized the total budget and chosen a structuring model, the next step is distribution. Divide the budget across channels, platforms, and teams based on performance potential and strategic priorities. Allocate funds to major categories such as digital channels (search, social, and email), traditional media (TV, radio, and print), events, content creation, public relations, and marketing technology. Each allocation should reflect where you expect the strongest returns and align with audience insights and ROI analysis. To benchmark channel mix and investment priorities, consult the latest CMO Survey results. This approach ensures every investment directly supports business goals and drives measurable growth.

The exact percentages will depend on what’s most effective for your business. Use the insights from Step 2 and Step 3 to guide your decision-making.

When allocating across channels, also consider internal factors: do you have the team or agency support to execute in those channels effectively? It’s better to allocate a bit less to a channel and execute it well than to spread thinly across too many channels without proper management.

Step 7: Plan tracking and reporting

The final step is to put in place a robust plan for tracking performance and reporting results.

Start by defining the KPIs that align with the goals you established in Step 1. These could include lead volume, customer acquisition cost, marketing-generated revenue, conversion rates, or brand awareness metrics, depending on your objectives.

Ensure you have systems to track these KPIs for each major marketing spend category.

.png)

Set up marketing dashboards that track spend and results in near real time. Monitoring actual expenditures against planned budgets ensures accountability and financial accuracy. Attribute measurable outcomes such as leads, sales, or pipeline growth to specific campaigns and channels. This visibility allows teams to identify underperforming areas quickly, reallocate funds efficiently, and demonstrate marketing’s direct contribution to business results.

Include a clear process for managing and adjusting the budget throughout the year. Define how the team will review spending, forecast needs, and approve changes. Schedule monthly budget review meetings to evaluate performance and predict upcoming expenses. Implement an approval workflow for any significant reallocations to maintain control and accountability. Consistent governance ensures transparency, prevents overspending, and keeps marketing investments aligned with evolving business goals. Effective CMO–CFO collaboration improves budgeting rigor and long‑term value creation – align on ROI, pacing, and reallocation rules up front.

How Much Should You Spend on Marketing? Key Factors Influencing Your Marketing Budget Plan

Beyond business goals and target audience, a marketing budget is also shaped by external and internal factors such as the competitive landscape, market trends, product lifecycle, and other criteria.

1. Industry and sector benchmarks

Recent data (Statista 2024) highlights a broad spectrum of marketing spend as a percentage of company budgets/revenue in various industries:

High-marketing industries

At the top end, consumer-driven sectors allocate the greatest share

| Industry | % of Revenue Spent on Marketing | Why |

|---|---|---|

| Consumer Packaged Goods (CPG) | ~25% | Heavy reliance on brand visibility and mass-market promotion to drive sales. |

| Professional Servicesa and Consulting | ~20-21% | Marketing and sales enablement are critical for acquiring and retaining clients. |

| Retail | ~14-15% | Intense competition and need for frequent campaigns to attract and engage customers. |

| Media and Communications | ~14-15% | High investment in promotions and customer engagement to stand out in crowded marketplaces. |

| Technology (Software and Platforms) | ~11-12% | Fierce competition for users and need to educate markets on new solutions. |

| SaaS (subset of Tech) | ~15% | Subscription growth models and competitive cost structures push higher marketing and sales investment. |

Lower-marketing industries

In contrast, industries with high regulation or capital intensity tend to allocate a smaller portion of their revenue to marketing.

| Industry | % of Revenue Spent on Marketing | Why |

|---|---|---|

| Financial Services (Banking, Insurance) | ~9-10% | Firms market extensively but also rely on established networks and face high non-marketing expenses. |

| Healthcare Providers and Related Services | ~6-7% | Focus on B2B relationships and referrals rather than mass marketing. |

| Pharmaceutical Industry (subset of Healthcare) | ~12-13% | Higher spend due to direct-to-consumer advertising requirements. |

| Industrial (Manufacturing, Energy, Construction) | ~3-4% | Prioritize sales teams, distributor relationships, or R/D; narrower customer bases reduce need for broad marketing. |

| Transportation | ~1-2% | Demand driven more by contracts and economic activity than by marketing campaigns. |

The takeaway for executives is that context matters: you should benchmark against companies in your sector and understand why those norms exist. If your spend is far below your industry’s average, you might be under-investing in growth; if it’s far above, ensure you’re gaining commensurate advantage. See comparative industry‑level budget shares for additional context by category.

2. Company size and stage

Larger enterprises tend to spend a smaller percentage of revenue on marketing than smaller companies.

For example, mid-sized firms ($100M–$1B revenue) often invest ~7–10% in marketing, whereas small businesses (<$10M) might invest 12–15% or more to establish their brand.

Once a company has established strong market traction, it may no longer need to sustain the high marketing spend ratios that young or growing companies typically require.

Enterprise-scale firms typically settle around single-digit percentages, though some mega-brands still invest above 10% for aggressive growth or brand dominance.

3. Product lifecycle stage

The stage of your products or services in their lifecycle will influence your marketing needs.

- New or launch-stage products typically require a large upfront marketing investment to build awareness and demand. In these cases, budget as a higher percentage of revenue (or even operate at a short-term loss) might be warranted to establish market presence.

- As products progress through the growth and maturity stages, marketing spend often shifts toward sustaining brand loyalty, differentiation, and potentially expanding into new segments.

- Mature brands with strong awareness can sometimes spend less as a percentage of sales, focusing on retention and incremental growth.

On the other hand, if your enterprise is introducing innovation or facing disruption, it may need a fresh surge in marketing even for a mature product to reposition or reinvigorate its image.

Always map your budget to product strategy: investing at the right time in the lifecycle can extend longevity and profitability.

4. Competitive landscape and market conditions

Operating in isolation is detrimental. Understanding current market shifts can significantly amplify campaign impact.

For instance, if the average marketing spend in your industry is 10.9% of revenue, and you're allocating only 5%, a reassessment might be needed to stay competitive.

If your key competitors are investing heavily in marketing, you risk losing mindshare if you don’t keep pace. Conversely, in niche or B2B markets with only a few players, heavy spending might yield diminishing returns. When budgeting under inflation and macro uncertainty, align allocation with the drivers that actually move prices. A concise primer: HBR – What Causes Inflation?

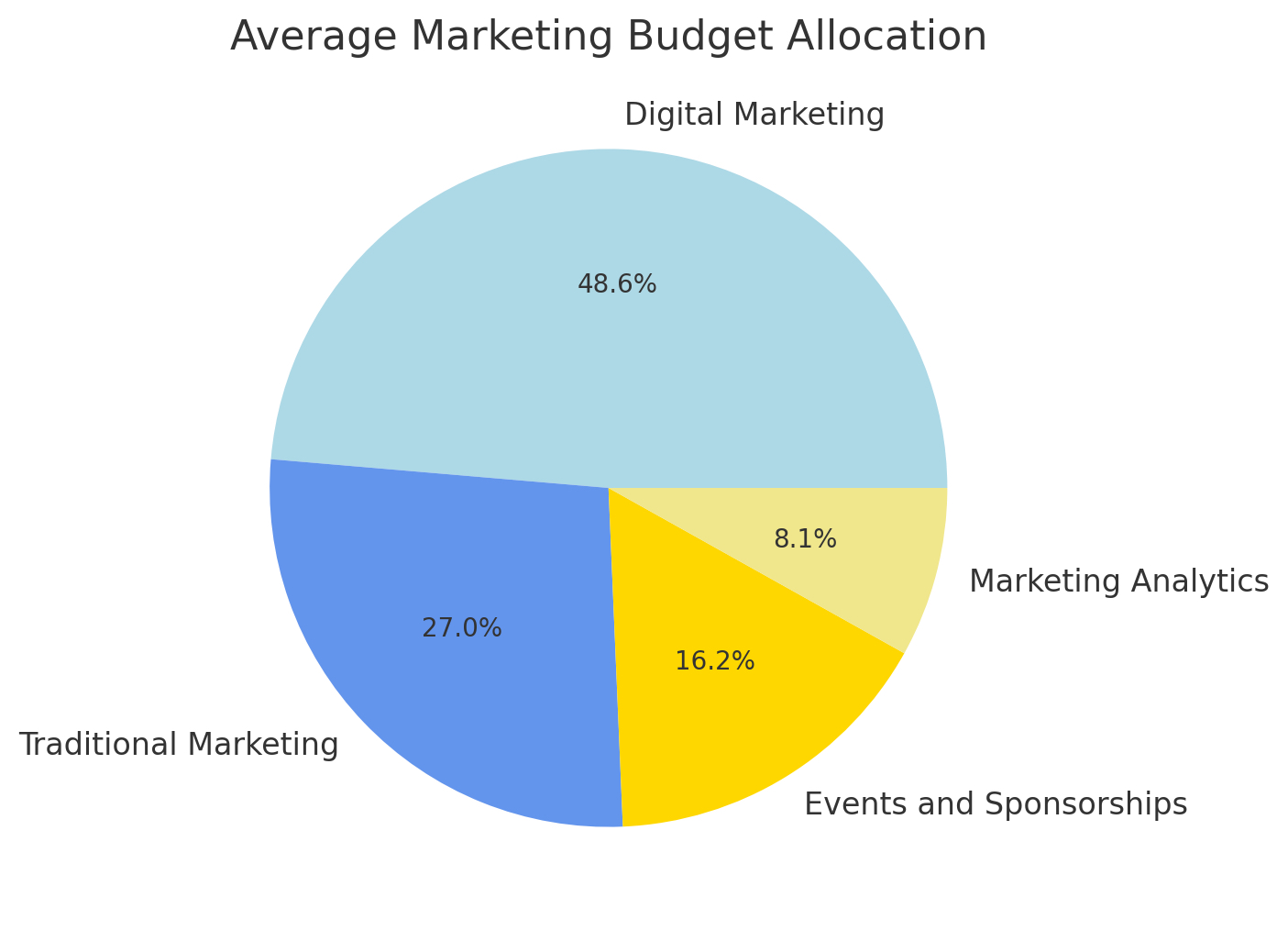

Typical Marketing Budget Allocation & Breakdown

While the ideal marketing budget allocation varies, a common marketing budget breakdown or marketing budget example might look like this:

- Digital Marketing: 40-60%. A significant portion is typically allocated to digital efforts. This includes website development, content marketing budget, SEO, paid advertising (PPC, social media ads), email marketing, and social media engagement. With consumers heavily relying on online channels, a strong digital marketing budget is crucial.

- Traditional Marketing: 15-25%. Channels like television, radio, print, and direct mail still hold value, especially for certain demographics or to enhance brand visibility alongside digital efforts.

- Events and Sponsorships: 10-20%. Face-to-face interactions, industry networking, and brand association through sponsorships can be powerful. This is where a budget for promotion can also fit.

- Content Marketing: (Often integrated within Digital, but can be a standalone focus ~10-25% of digital or overall). Creating valuable content (blogs, videos, infographics) drives organic traffic, educates audiences, and builds authority.

- Social Media Marketing: (Often integrated within Digital, but specific allocation is key ~5-15% of digital or overall). Building communities and engaging with customers on relevant platforms requires a dedicated social media marketing budget.

- Research, Analytics & Optimization Tools: 5-15%. Crucial for data-driven decisions. Investing in marketing analytics platforms like Improvado allows businesses to measure campaign impact, gain consumer insights, and optimize marketing spend. Advanced analytics can yield a 140-400% 3-year ROI.

U.S. CMOs report shifting budgets from traditional to digital year over year.

This budget allocation for digital marketing and other channels should be flexible and reviewed regularly.

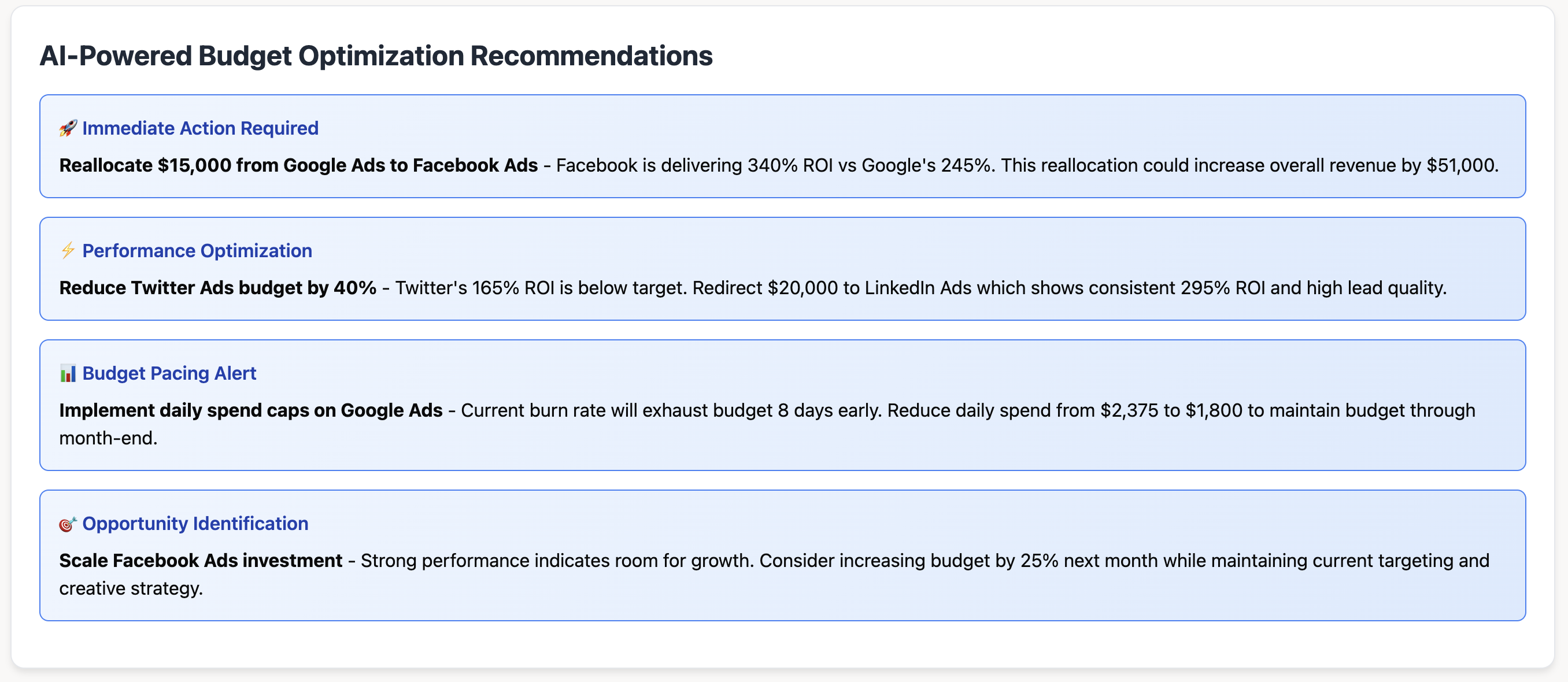

Optimizing and Managing Your Marketing Budget for Maximum ROI

.png)

For enterprise teams, marketing budgets can't just live in spreadsheets or quarterly forecasts—they need to operate as dynamic systems that respond to live performance data. Improvado bridges budgeting and analytics by unifying spend and performance data from every channel, platform, and region into a single source of truth.

With Improvado, operations leaders gain real-time visibility into spend against plan, enabling them to make proactive budget reallocations before wasted spend compounds. Campaign data is automatically harmonized and mapped to financial dimensions, such as region, product line, or business unit, providing marketing and finance teams with a shared lens on ROI.

Analytics and data teams benefit from customizable dashboards that directly tie budget allocation to pipeline, CAC, and LTV metrics, ensuring leadership sees not just spend, but also measurable business impact.

By integrating directly with BI tools or delivering insights through Improvado’s AI Agent, the platform empowers faster decision-making at both tactical and strategic levels.

For marketing leadership, Improvado’s budget insights provide the confidence to scale investment while maintaining accountability. Rather than relying on delayed reports, executives can model “what-if” scenarios, compare budgeted vs. actual ROI, and ensure every dollar spent aligns with growth priorities.

.png)

.png)