Fintech marketing operates in one of the most competitive digital arenas with one of the highest customer acquisition costs (CACs) across sectors, averaging $784 per customer. New products launch constantly. Customer expectations rise quickly. Differentiation is difficult, and trust is fragile.

As competition intensifies, attracting, nurturing, and converting prospects becomes more expensive. The result is rising customer acquisition costs and shrinking margin for error. Without a disciplined marketing strategy, fintech companies risk stalled growth and lost market share.

This guide breaks down how high-performing fintech teams solve these challenges. It covers core marketing strategies, priority acquisition channels, and the analytics infrastructure required to scale efficiently.

Key Takeaways:

- Fintech marketing success hinges on building and maintaining customer trust through transparency, security, and educational content.

- A unified view of marketing data is essential for understanding the customer journey, optimizing spend, and proving ROI in a complex, multi-channel environment.

- Given the "Your Money or Your Life" nature of finance, high-quality, educational content is the primary vehicle for building authority and attracting high-intent users.

- Successful fintech brands move beyond transactions to build communities, fostering loyalty and turning users into advocates.

- Every marketing activity must be viewed through the lens of strict financial regulations to avoid costly legal and reputational damage.

The Core Pillars of a Winning Fintech Marketing Strategy

Before diving into specific tactics, it's crucial to establish a solid strategic foundation.

Fintech marketing isn't about chasing fleeting trends. It's about building a sustainable growth engine based on deep customer understanding and unwavering trust.

Defining Your Target Audience & Ideal Customer Profile (ICP)

In fintech, audience definition determines profitability. Acquisition costs are high, trust thresholds are strict, and customer lifetime value varies dramatically across segments. Targeting everyone is financially unsustainable.

An effective ICP goes beyond age and income. It incorporates financial behaviors, transaction frequency, savings patterns, credit needs, risk tolerance, and digital engagement habits. These attributes determine not only who converts, but who stays, upgrades, and becomes profitable over time.

Different segments carry different economic profiles. Some users seek quick access to financial tools but churn early. Others require longer education cycles but deliver stronger retention and higher lifetime value. Mapping these value tiers guides channel investment, onboarding flows, and messaging strategy.

ICP definition also informs compliance and trust-building efforts. Risk disclosures, security messaging, and pricing explanations must reflect the expectations and financial literacy of each segment.

When ICP design is precise, acquisition efficiency improves, activation friction drops, and marketing spend scales with predictability.

Building Trust and Credibility: The Bedrock of Fintech

Trust is the currency of the financial world. You can build it through several key initiatives:

- Radical transparency: Be open about your fees, business model, and even your mistakes. Monzo famously built its brand by sharing internal communications and profitability reports, treating customers like partners.

- Social proof: Prominently feature customer testimonials, case studies, Trustpilot ratings, and media mentions.

- Security first: Clearly communicate your security measures (encryption, fraud protection, insurance) to reassure users their assets are safe.

- Expert content: Consistently publish content that demonstrates deep expertise in your niche, positioning your brand as a reliable source of information.

Navigating the Complex Regulatory & Compliance Landscape (YMYL)

Fintech marketing operates under strict financial and consumer protection laws. Any claim related to money, investing, lending, or personal financial outcomes falls under “Your Money or Your Life” (YMYL) standards. This means marketing content is held to a higher bar for accuracy, transparency, and substantiation.

Regulatory oversight comes from multiple bodies:

- The SEC governs investment-related messaging.

- The FTC enforces truth-in-advertising standards.

- The CFPB monitors consumer financial products.

- State-level regulators add additional requirements for lending, money transmission, and data privacy.

Each channel, from paid ads to landing pages to influencer partnerships, must comply with these frameworks.

Marketing teams must ensure that performance claims are verifiable, fees are clearly disclosed, risk language is visible, and disclaimers are properly presented. Misleading projections, hidden terms, or vague benefit statements can trigger audits, fines, or forced content takedowns. Beyond legal risk, compliance failures erode user trust in seconds.

Content approval workflows must be structured to include legal review without slowing campaign execution. Version control, claim substantiation libraries, and audit trails are essential.

Foundational Fintech Digital Marketing Channels

With a solid strategy in place, you can execute across a blend of digital channels. The key is to create an integrated system where each channel supports the others to guide users seamlessly from awareness to advocacy.

Content Marketing: Education as a Conversion Engine

In fintech, content is not brand storytelling. It is pre-conversion infrastructure. Users must understand the product, evaluate risk, and trust the provider before committing money or sensitive data.

Effective fintech content programs typically include:

- Educational articles and explainers that clarify financial concepts, product mechanics, and risk considerations

- In-depth guides and playbooks that support high-consideration decisions such as investing, lending, or cash management

- Webinars and expert sessions that establish authority and allow real-time trust-building

- Comparison and alternative pages that capture bottom-funnel demand while signaling transparency

Performance is measured not only by traffic, but by downstream activation rate, funded account completion, and retention lift.

Search Engine Optimization (SEO): Capturing High-Intent Users

SEO in fintech targets high-intent financial queries under strict YMYL standards. Rankings require both technical performance and demonstrated subject-matter credibility.

Core focus areas include:

- Intent-tiered keyword strategy across informational, evaluative, and transactional queries

- Technical performance including speed, mobile stability, and secure infrastructure

- E-E-A-T signals such as expert authorship, cited sources, and reputable backlinks

- Regulatory-safe language that avoids misleading financial claims

SEO success in fintech is as much about trust validation as it is about ranking position.

Social Media Marketing: Building Community and Engagement

Social media for fintech is less about direct sales and more about brand building, community engagement, and customer support.

Platforms like LinkedIn are ideal for B2B fintech, while Twitter (X), and Instagram can be effective for B2C brands that focus on financial literacy and lifestyle integration.

The key is to provide value, not just pitch products. Share market insights, host Q&A sessions, and celebrate customer success stories.

Paid Advertising (PPC & Social Ads): Precision Targeting for Growth

Paid media is a primary growth lever in fintech. It requires strict control over intent targeting, compliance, and downstream conversion quality.

- Search Ads (Google & Bing): Target high-intent financial queries tied to concrete user actions. Examples include “open business checking account,” “instant loan approval,” or “brokerage account fees.” Campaigns separate informational, evaluative, and transactional intent to control bidding efficiency. Smart Bidding is optimized toward verified outcomes such as funded accounts, approved applications, or completed identity checks.

- Social Ads (LinkedIn, Meta, TikTok): LinkedIn targets professional attributes such as job title, company size, and industry for B2B financial products. Meta and TikTok target consumer financial behaviors, life events, and interest clusters. Creative is structured to reduce trust friction, explain product value quickly, and pre-qualify users before click.

- Compliance and Policy Enforcement: Ad copy must meet FTC truth-in-advertising standards, CFPB disclosure requirements, and platform-specific financial ad policies. Claims require substantiation. Risk disclaimers must be visible. Non-compliant assets risk account suspension, not just ad rejection.

- Landing Page and Funnel Control: Post-click flows are optimized for security reassurance, pricing transparency, and low-friction onboarding. Drop-off during KYC, credit checks, or funding steps is tracked as a core performance metric. Conversion success is measured by activated users, not raw leads.

Fintech Marketing Channels: B2C vs. B2B Comparison

Marketing to individual consumers (B2C) is vastly different from marketing to businesses (B2B). Understanding these differences is key to choosing the right channels and crafting the right message.

| Aspect | B2C Fintech Marketing | B2B Fintech Marketing |

|---|---|---|

| Primary Goal | Mass user acquisition, brand awareness, app downloads. | Lead generation, nurturing complex sales cycles, building partnerships. |

| Key Channels | Social Media (Instagram, TikTok, X), Influencers, SEO, Content Marketing, App Store Optimization (ASO). | LinkedIn, Content Marketing (Whitepapers, Webinars), Account-Based Marketing (ABM), Industry Events. |

| Messaging Focus | Simplicity, convenience, emotional connection, lifestyle benefits (e.g., "Save effortlessly"). | ROI, efficiency, security, compliance, integration capabilities (e.g., "Streamline your AP process"). |

| Sales Cycle | Short; often immediate or within days. | Long; can take months or even years, involving multiple decision-makers. |

| Key Metrics | Cost Per Install (CPI), Customer Acquisition Cost (CAC), User Engagement, Churn Rate. | Cost Per Lead (CPL), Marketing Qualified Leads (MQLs), Sales Qualified Leads (SQLs), Pipeline Value. |

| Content Strategy | Educational blog posts, how-to videos, social media content, financial literacy tools. | In-depth whitepapers, case studies, industry reports, ROI calculators, expert webinars. |

Advanced Fintech Growth Strategies in 2026

The foundational channels are essential, but to truly break away from the pack, fintech marketers must embrace more innovative and engagement-focused strategies.

Fintech growth in 2026 is defined by automation maturity, real-time decisioning, and trust infrastructure. Acquisition channels are saturated. Marginal gains now come from execution precision, lifecycle intelligence, and data discipline.

#1. Generative Engine Optimization (GEO)

Similar to any other industry, search behavior is shifting from keywords to conversational queries inside AI assistants and answer engines. Fintech discovery increasingly happens through generated responses rather than traditional search result pages.

GEO focuses on making financial products and educational content machine-readable, entity-rich, and contextually retrievable by AI models. This includes structured data, consistent product definitions, authoritative content clusters, and verified brand knowledge graphs.

AI engines prioritize sources with clear expertise signals, transparent data provenance, and consistent terminology. Fintech brands that structure content for machine comprehension gain visibility in AI-generated recommendations, not just web search rankings.

GEO becomes the new SEO for financial discovery in an AI-first internet.

#2 Event-Triggered Lifecycle Orchestration

Lifecycle marketing is now built on real financial events rather than scheduled campaigns. The strategy is to align communication with user behavior and financial context.

Typical trigger maps include:

- Account funded but no first transaction within 24 hours

- Card issued but not activated

- Portfolio drawdown beyond a threshold

- Salary deposit detected

- Credit utilization spike

- Inactive app sessions over 7 days

Each trigger activates a defined sequence across channels. Push notifications drive immediate re-engagement. In-app messages deliver contextual education. Email provides longer-form guidance. Retargeting ads reinforce the message externally.

These flows are owned jointly by growth, product, and risk teams. Messaging content, offer structure, and timing are aligned with compliance rules and customer risk profiles.

Retention becomes an automated behavioral system, not a quarterly campaign.

#3 Community-Led Activation Campaigns

Fintech communities are structured as conversion environments.

Brands run gated learning cohorts for investing basics, credit improvement, or savings habits. Users join via paid ads or referral loops. Over 2–4 weeks, they receive guided lessons, interactive tools, and live sessions. AI personalizes lesson order based on quiz performance and in-app behavior.

At defined milestones, participants receive product prompts. For example:

- After completing a budgeting module → savings account offer

- After completing investment risk training → portfolio builder prompt

Completion and engagement scores feed back into acquisition targeting. High-converting community profiles become new lookalike seeds on ad platforms.

Education is no longer content marketing. It is a controlled activation funnel.

#4 Value-Based Media Buying

Media buying is optimized for contribution margin, not lead volume.

Before campaigns launch, predictive models score audience segments on:

- Expected lifetime value

- Probability of account funding

- Expected servicing cost

- Fraud and compliance risk

- Predicted churn window

These scores are passed into bidding systems. High-value cohorts receive higher bid ceilings. Low-value or high-risk cohorts are excluded or capped. Creative messaging also changes by predicted value tier.

Channel mix decisions follow unit economics, not surface metrics. A channel with higher CPM but stronger funded-account rates may receive more budget than cheaper traffic sources.

Acquisition becomes finance-driven, not media-driven.

#5 Embedded Distribution Execution

Growth teams now build distribution inside partner ecosystems.

Common integrations include:

- Payroll platforms offering early wage access

- Ecommerce checkout offering embedded lending

- Creator platforms offering payout accounts

- Accounting software offering SMB banking

Each integration has defined KPIs: activation rate, funded account rate, fraud rate, retention at 90 days. AI monitors performance by partner, placement, and user cohort.

Underperforming integrations receive new onboarding flows or incentive tests. High-performing partners receive expanded product placement and co-marketing investment.

Growth shifts from buying ads to engineering distribution surfaces.

#6 Referral-Led Growth Loops

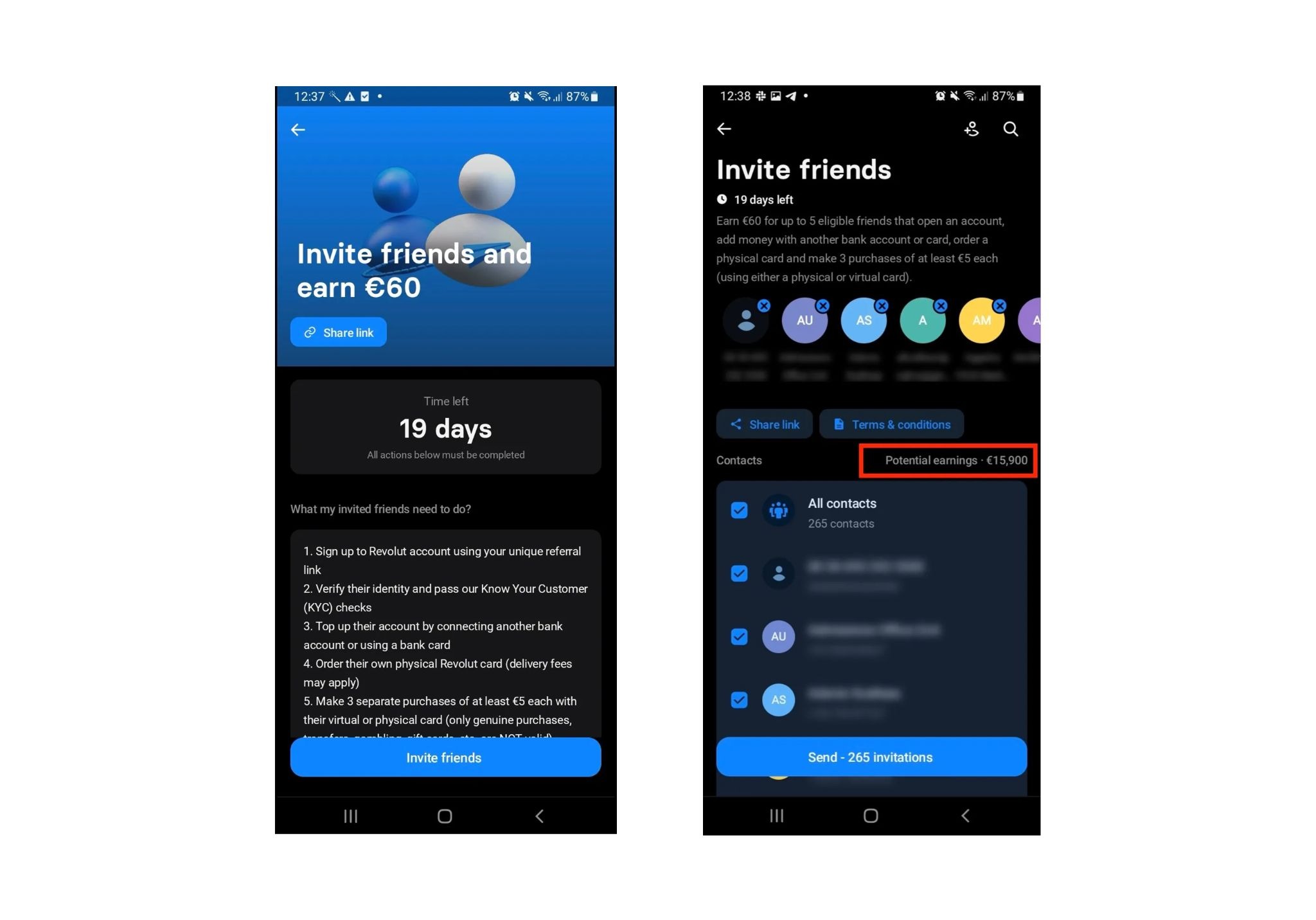

Referral programs in fintech have matured beyond simple “give $10, get $10” mechanics. The strategy is to design referral flows that mirror trust transfer. Financial products carry higher perceived risk. Referrals reduce that friction when structured correctly.

Modern referral systems trigger invitations at high-confidence moments. Common triggers include successful first transaction, savings goal completion, or investment milestone reached. Rewards are tiered based on referee activation depth, not just sign-up. For example, a reward is released only after the referred user funds an account or completes KYC.

#7 Cross-Product Expansion Campaigns

Fintech growth is no longer driven by single-product acquisition. The strategy is to increase share of wallet through structured cross-product expansion.

User data is analyzed to identify readiness signals for adjacent products. For example, consistent savings balances trigger investment prompts. Regular business deposits trigger SMB lending offers. High card usage triggers premium account upgrades.

Cross-sell campaigns run through coordinated in-app experiences, triggered email sequences, and personalized ad retargeting. Messaging focuses on next-step financial needs rather than generic upsell. AI models measure conversion probability and suppress irrelevant offers to avoid trust erosion.

Growth shifts from acquiring more users to deepening product penetration per user.

#8 Brand-Led Cultural Positioning

Fintech markets are crowded with products that offer similar features, pricing, and user experience. Functional differentiation is no longer enough. The strategy is to build cultural relevance so the brand stands for something beyond payments, banking, or investing.

This is executed by placing the brand inside entertainment, lifestyle, and social conversations rather than limiting exposure to performance ads. Long-form storytelling, cinematic production, creator partnerships, and experiential activations replace traditional product-led messaging. The objective is to generate emotional association and memorability at scale.

Brand-led cultural positioning increases trust, improves conversion rates across lower-funnel campaigns, and reduces long-term acquisition costs. It turns brand equity into a measurable growth asset rather than an awareness expense.

Cash App applied brand-led cultural positioning by releasing a cinematic short film directed by Aidan Zamiri and starring Timothée Chalamet. Instead of promoting product features, the film used humor and character-driven storytelling to explore attitudes toward digital payments and financial confidence. The campaign generated mass-reach entertainment exposure rather than standard ad impressions, with the video surpassing 14 million views on YouTube.

The Data-Driven Fintech Marketer: Analytics & Measurement

Fintech marketing operates under financial scrutiny. Every dollar must be accountable, and every strategy must be backed by data.

Why Unified Marketing Analytics is Non-Negotiable

Fintech customer journeys are long and multi-threaded. Each step generates data in a different platform, with different naming conventions, metrics, and attribution logic.

When data remains siloed, performance analysis becomes distorted. Paid channels appear more effective than they are. Education and brand touchpoints are undervalued. Funnel bottlenecks inside onboarding or KYC remain hidden.

Tracking the Full Customer Journey Across Channels

Fintech funnels rarely convert on first touch. Consideration cycles include trust-building, education, compliance steps, and funding actions. Without cross-channel journey tracking, teams optimize only for the easiest conversions, not the most valuable customers.

Unified journey mapping shows which channels initiate intent, which reduce friction, and which close funded accounts. It also reveals where users drop during KYC, onboarding, or first transaction steps. Budgets can then be assigned to remove friction points, not just buy traffic.

This shifts optimization from last-click thinking to lifecycle engineering.

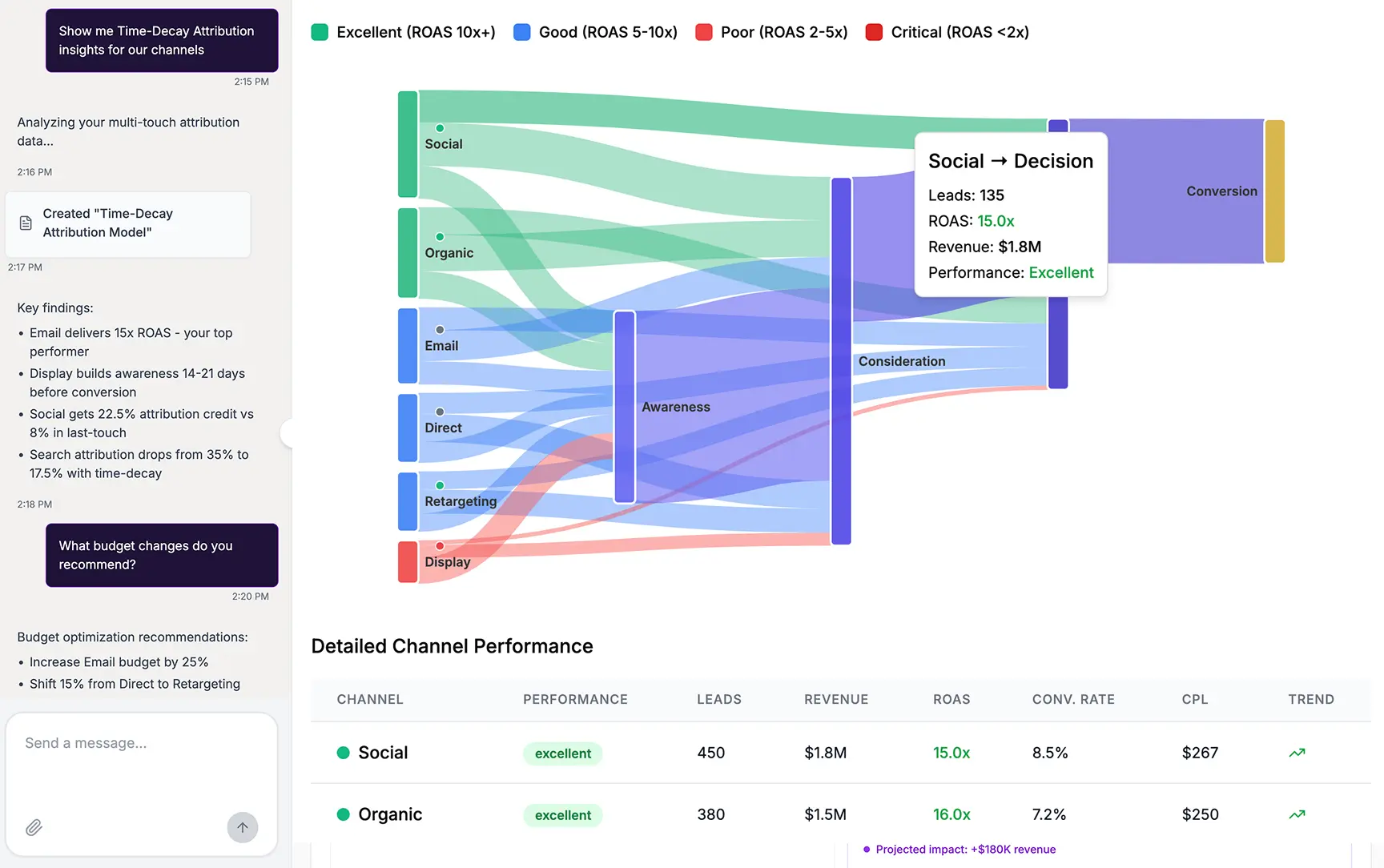

Proving ROI with Advanced marketing attribution models

Last-click attribution underestimates upper-funnel and education-driven channels. In fintech, these channels are often responsible for trust formation, not immediate conversion. Ignoring them biases budget allocation toward short-term performance and erodes long-term growth.

Advanced attribution models distribute value across touchpoints based on actual contribution. Time-decay models reflect long consideration cycles. Data-driven models learn which sequences produce funded accounts and retained users. This allows brand campaigns, educational content, and community programs to be measured with financial credibility.

Attribution becomes a financial decision tool, not a reporting artifact.

Using KPI dashboards to monitor performance in real-time

Fintech markets move with news cycles, market volatility, and competitor offers. Monthly reporting is too slow. Teams need continuous visibility into CAC, LTV, activation rates, onboarding completion, funding rates, and churn.

Real-time dashboards provide operational control. Sudden drops in KYC completion, spikes in acquisition cost, or declines in funded account rates are detected early. Interventions happen immediately, not after wasted spend accumulates.

Dashboards are no longer reporting tools. They are control panels for growth operations.

Optimizing Your Marketing Operations for Efficiency

A brilliant strategy is useless without efficient execution. A strong strategy fails if operations cannot support it. Operational infrastructure is now a growth lever.

Automating Reporting to Eliminate Manual Work

Manual reporting is still common in fintech marketing. Teams export Facebook Ads data, CRM records, app events, and revenue reports into spreadsheets. Hours are spent reconciling naming mismatches, fixing formulas, and validating totals.

Errors slip through. By the time reports are ready, performance has already shifted.

Improvado replaces this workflow with automated data pipelines. It connects directly to marketing platforms, analytics tools, product databases, and revenue systems. Data is ingested on scheduled refresh cycles, standardized into consistent schemas, and delivered into reporting environments without manual handling.

This automation does more than save time. It removes human error from financial reporting, accelerates optimization cycles, and ensures leadership always sees current performance, not last week’s estimates. Teams redirect effort from building reports to improving outcomes.

Building a Unified Marketing Data Stack

Fintech stacks are complex by design. CRM systems manage leads and KYC status. Product analytics track onboarding and transactions. Ad platforms manage acquisition. Revenue systems track deposits, balances, and fees. When these systems remain disconnected, marketing decisions rely on partial data.

Improvado functions as the data foundation that connects these layers. It aggregates marketing, product, and revenue data into a unified warehouse model. It aligns campaign naming, conversion events, user identifiers, and financial metrics across platforms. Governance rules validate tracking and attribution logic before data reaches dashboards.

With this foundation in place, fintech organizations gain a single source of truth for acquisition cost, activation rates, funded accounts, retention, and lifetime value. Media teams, product teams, finance, and leadership operate from the same dataset and definitions.

Enabling Scalable Analytics and AI-Driven Operations

Once data is unified and governed, analytics becomes scalable. Improvado delivers analysis-ready datasets into BI tools for deep exploration. On top of this, Improvado AI Agent provides natural-language access to performance data. Teams ask questions, generate dashboards, detect anomalies, and receive optimization suggestions without manual querying.

This shifts marketing operations from static reporting to continuous intelligence. Budget adjustments, creative changes, and lifecycle interventions happen faster. Decisions are based on verified data, not fragmented platform views.

Conclusion

Fintech marketing is a marathon, not a sprint. Success is built on a relentless commitment to earning and maintaining trust, a deep understanding of the customer, and a sophisticated, data-driven approach to measurement and optimization. By building a strong strategic foundation, executing across a blend of foundational and advanced channels, and underpinning everything with a unified analytics infrastructure, you can cut through the noise of a crowded market.

The brands that will win in the next decade are not just those with the best technology, but those that master the art and science of marketing. They will build communities, educate their users, operate with transparency, and leverage data as their most critical strategic asset. Your journey to becoming a leader in the fintech space starts with a commitment to these principles today.

.png)

.jpeg)

.png)